2025 Multifamily Gold Mine: Seizing Opportunities in Housing Market Shift

- Authors

- Published on

- Published on

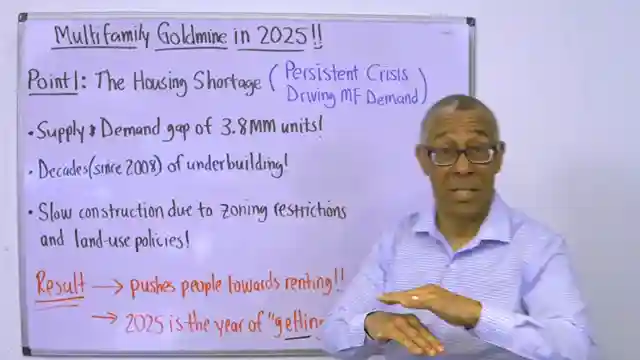

Today on Commercial Property Advisors, we're delving into the roaring multifamily market of 2025, a gold mine waiting to be seized. The housing crisis, with a staggering 3.8 million unit gap, is propelling renters towards multifamily properties. Slow construction, high interest rates, and restrictive zoning policies have created a perfect storm, pushing individuals towards renting rather than buying. This is where the savvy investor strikes gold.

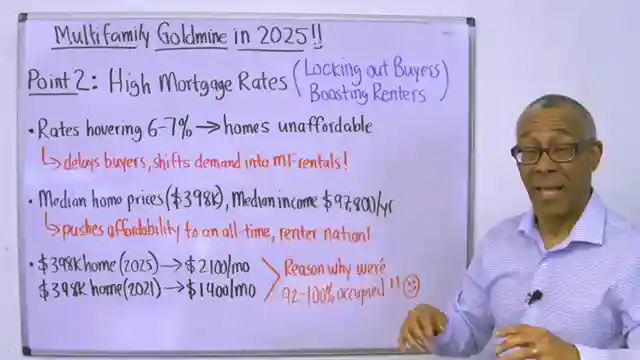

Furthermore, the surge in mortgage rates is boxing out potential buyers, particularly first-timers, and fueling the demand for rentals. With rates hovering between six and 7%, the dream of homeownership is slipping away for many. The median home price hitting $398,000 is putting homeownership out of reach for the average American. This financial juggling act is turning the nation into a renter's paradise, with multifamily properties reaping the benefits of this shift.

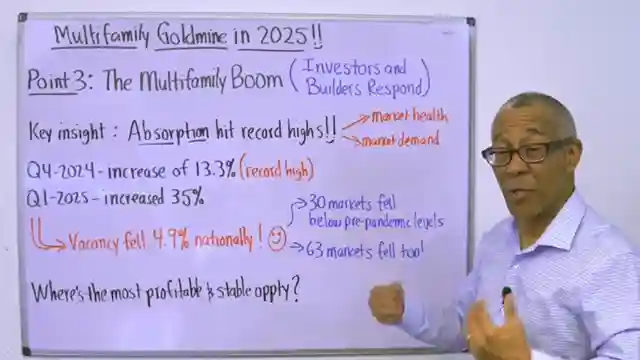

Moreover, the multifamily boom is in full swing, with absorption rates skyrocketing to record highs. Absorption, the lifeblood of the multifamily market, is a key indicator of market health and demand. As builders struggle to keep pace with demand, vacancy rates are plummeting nationwide. The real opportunity lies in B and C-class multifamily properties, where existing units are thriving due to the inability to construct new affordable housing. The time to act is now, before the market becomes a battleground of inflated prices and fierce competition.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Multifamily Goldmine in 2025 on Youtube

Viewer Reactions for Multifamily Goldmine in 2025

Commercial real estate investors benefit from having a mentor

Comment on a worker's facial expression in the video

Positive feedback on the content

Difficulty finding multifamily apartments in Massachusetts

Questions about the Protege program offered

Concerns about high interest rates impacting investment decisions and rental rates

Related Articles

Mastering Multifamily Investments: Key Lessons for Success

Learn crucial multifamily property investment lessons from Commercial Property Advisors: prioritize cash flow and reserves, invest in top-notch property management, understand neighborhoods, start small, and take action over analysis paralysis for success in real estate.

Mastering Real Estate Funding: The 3 Essential Keys

Learn the three essential keys to effortlessly raising money for real estate deals from Commercial Property Advisors. Discover how to assess deal worthiness, position yourself attractively, and align opportunities with investor needs for successful funding.

Maximize Wealth: Why Choose Commercial Real Estate Over Stocks

Discover why Commercial Property Advisors recommends commercial real estate over stocks. Learn about predictability, cash flow, leverage, tax benefits, and building a lasting legacy through tangible assets. Gain control and stability in wealth-building today.

From Layoff to Real Estate Tycoon: Jaden's $14M Success Story

Follow Jaden's inspiring journey from corporate layoff to owning $14 million in multifamily properties. Learn how strategic investing and perseverance led to his success in commercial real estate.