2025 US Economic Outlook: Recession Risks, Home Prices, and Stock Market Analysis

- Authors

- Published on

- Published on

In this episode of Reventure Consulting, we delve into the looming specter of a US economic recession in 2025. The team examines key indicators like home and stock prices, as well as the unemployment rate, painting a grim picture of the nation's financial landscape. Warning signals abound, with major corporations such as Delta, United Airlines, Dollar General, and Target issuing cautionary statements about the economy. Job openings have seen a drastic decline, while continuing unemployment claims are on the rise, indicating a challenging job market.

The discussion takes a sharp turn towards the impact of the Trump presidency on government spending and immigration, with layoffs and economic weakness becoming prevalent. The reduction in immigration could spell trouble for job growth and consumer spending, as highlighted by a study from John Burns Real Estate Consulting. This slowdown in immigration could have a ripple effect on rental housing demand, potentially leading to a drop in home prices. Pending home sales have also taken a hit, showcasing a decrease in home buyer demand amidst economic uncertainties.

As the narrative unfolds, retail spending faces a downturn due to various factors like cold weather, declining consumer confidence, and tariff concerns. The economy finds itself perched precariously on the edge of a bubble, with soaring debt, home prices, and stock prices painting a concerning picture. Consumer savings are dwindling, further exacerbating the economic fragility. The team sheds light on the overvaluation of both the stock and housing markets, hinting at an impending economic recalibration. The unsustainable nature of the Federal Reserve's actions, such as cutting interest rates and printing money, adds another layer of complexity to the economic puzzle.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch U.S. recession odds spike. Prepare for downturn in 2025. on Youtube

Viewer Reactions for U.S. recession odds spike. Prepare for downturn in 2025.

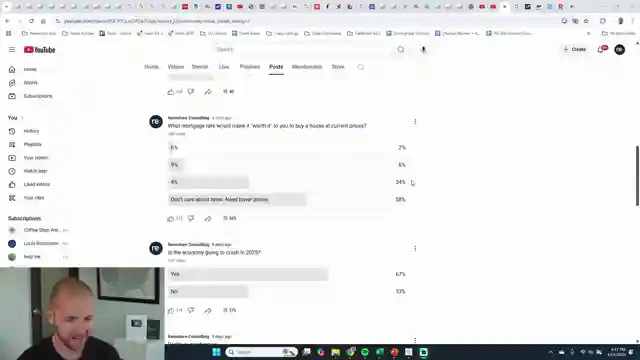

Polymarket odds indicate a 43% chance of recession in 2025, doubling over the last month

Some users believe we are already in a recession, especially for the middle class

Observations include full Christmas tree lots on Christmas Eve, slow depression, and stressed American consumers

Concerns about high prices, low savings, and shaky confidence leading to an inevitable recession

Comments on housing market struggles, high prices, and difficulties for young families

Mention of layoffs increasing, stagnant home sales, and waiting for prices to fall

Criticisms of government numbers, wages not keeping up with inflation, and impending economic collapse

Speculation on the impact of government deficits and the Trump administration on the economy

Debate on the effects of tariffs, government spending, and immigration policies on the economy

Mixed opinions on the current economic situation, with some calling for a collapse and others expressing concern about the future

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.