Avoiding Negative Cash Flow: Expert Tips for Rental Properties

- Authors

- Published on

- Published on

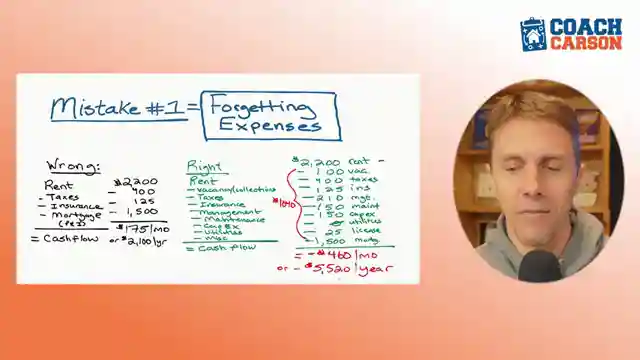

In this riveting episode by Coach Carson, the team delves into the treacherous waters of negative cash flow rental properties, aptly nicknamed "alligators" for their insatiable appetite for money. Drawing from over two decades of real estate experience, they unveil five critical blunders that can lead investors down a path of financial ruin. The first misstep highlighted is the failure to account for all expenses upfront, including often overlooked costs such as vacancies, management fees, and maintenance expenses. By neglecting these crucial factors, investors set themselves up for a perilous financial downfall.

Moving on, the team shines a spotlight on the dangers of purchasing older, seemingly affordable properties in pursuit of better cash flow. Contrary to popular belief, these properties can quickly turn into money pits due to unforeseen capital expenses and maintenance issues. The cautionary tale shared by Coach Carson serves as a stark reminder of the hidden pitfalls that lie within these seemingly lucrative investment opportunities. Moreover, the discussion shifts towards the critical role of financing in determining cash flow outcomes. By opting for longer mortgage terms and exploring creative financing solutions, investors can wield significant control over their financial success in the real estate realm.

Furthermore, the team underscores the evolving landscape of down payments in real estate investing, emphasizing the diminishing efficacy of the traditional 20% down payment model. With interest rates on the rise, investors must recalibrate their financial strategies to navigate the shifting tides of the market. Through a blend of insightful analysis and real-world examples, Coach Carson and his team deliver a masterclass in avoiding the pitfalls that lead to negative cash flow in rental properties. By heeding their sage advice and learning from their experiences, investors can chart a course towards sustainable profitability in the competitive world of real estate investment.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch 5 Mistakes That Create Negative Cash Flow Rentals on Youtube

Viewer Reactions for 5 Mistakes That Create Negative Cash Flow Rentals

Viewer appreciates the useful and easy-to-follow video

Viewer is looking forward to implementing strategies in their next rental

Commenter finds the video very helpful and thanks for sharing

Question about using the 70 percent rule for single-family properties

Related Articles

Mastering Anti-Fragility in Real Estate: Strategies for Success

Coach Carson explores anti-fragility in real estate investing, advising on strategic cash reserves, debt management, and the power of small, flexible deals for long-term success.

DSCR Loans: Flexible Financing for Real Estate Investors

Discover the power of DSCR loans for real estate investors with Coach Carson and mortgage expert Brian Maddox. Learn how these flexible loans based on rental income can benefit self-employed individuals and foreign nationals, offering an alternative to traditional financing.

Top Real Estate Books: Millionaire Strategies, Survival Tactics & Expert Insights

Explore top real estate books: "The Millionaire Real Estate Investor," "The Real Estate Game," "Building Wealth One House at a Time," and more. Gain insights from millionaire investors, survival tactics, and expert strategies for intelligent decision-making in real estate.

Build the Rent Strategy: Navigating Rising Costs in Real Estate

Coach Carson explores the benefits of Build the Rent strategy, emphasizing the appeal of new properties in attracting top tenants and navigating rising costs in real estate investing.