Benjamin Franklin's Path to Early Retirement & Financial Freedom

- Authors

- Published on

- Published on

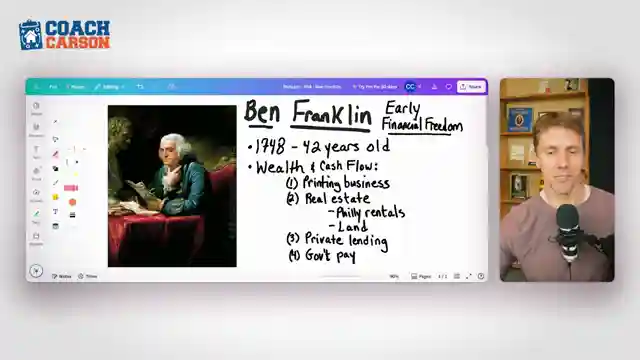

In this riveting episode, Coach Carson delves into the fascinating tale of Benjamin Franklin's early retirement at the ripe age of 42. Forget the modern-day FIRE movement; Franklin was the OG of financial independence, stepping away from his printing business to bask in the glory of early retirement. But don't picture him lounging on a beach with a cocktail - Franklin was a man of action, utilizing various income streams like entrepreneurship, real estate, and private lending to secure his financial future.

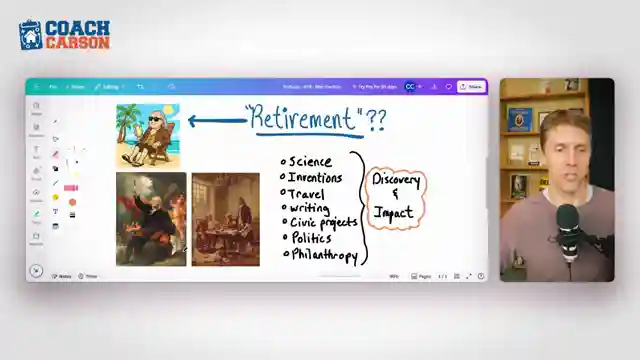

Franklin wasn't just about the money; he was a polymath extraordinaire, dabbling in science, inventions, and civic projects. From pioneering electricity experiments to inventing bifocals and lightning rods, Franklin's legacy reverberates through the annals of history. His foray into politics, diplomacy, and philanthropy further solidified his status as a founding father and a true Renaissance man.

Coach Carson draws inspiration from Franklin's emphasis on frugality, hard work, and strategic investing as pillars of financial freedom. The narrative transcends mere wealth accumulation, urging viewers to ponder their values, aspirations, and potential impact on society. As a beacon of enlightenment, Franklin's story underscores the profound significance of defining one's legacy and making a meaningful contribution to the world.

In a bid to empower investors seeking financial independence, Coach Carson introduces Rental Property Mastery, a bespoke community tailored for those navigating the intricate realm of real estate. From property acquisition strategies to financing tactics and efficient management systems, the program equips participants with the tools to embark on their own journey towards prosperity. Join the ranks of small and mighty investors at coachcarson.comrpm and unleash your potential in the realm of real estate mastery.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How Ben Franklin Retired Early at 42 in 1748! on Youtube

Viewer Reactions for How Ben Franklin Retired Early at 42 in 1748!

Ben Franklin as a small and mighty investor

Request for more episodes like this

Appreciation for the content and additional weekly videos

Related Articles

Mastering Anti-Fragility in Real Estate: Strategies for Success

Coach Carson explores anti-fragility in real estate investing, advising on strategic cash reserves, debt management, and the power of small, flexible deals for long-term success.

DSCR Loans: Flexible Financing for Real Estate Investors

Discover the power of DSCR loans for real estate investors with Coach Carson and mortgage expert Brian Maddox. Learn how these flexible loans based on rental income can benefit self-employed individuals and foreign nationals, offering an alternative to traditional financing.

Top Real Estate Books: Millionaire Strategies, Survival Tactics & Expert Insights

Explore top real estate books: "The Millionaire Real Estate Investor," "The Real Estate Game," "Building Wealth One House at a Time," and more. Gain insights from millionaire investors, survival tactics, and expert strategies for intelligent decision-making in real estate.

Build the Rent Strategy: Navigating Rising Costs in Real Estate

Coach Carson explores the benefits of Build the Rent strategy, emphasizing the appeal of new properties in attracting top tenants and navigating rising costs in real estate investing.