Demystifying Real Estate Investor Types and Market Myths

- Authors

- Published on

- Published on

In this riveting episode, Coach Carson fearlessly tackles the age-old debate surrounding Real Estate Investors, separating them into distinct categories like Wall Street tycoons, quick Buck enthusiasts, and the valiant small and mighty investors epitomized by "One Rental at a Time." With his signature flair, Carson champions the latter group, highlighting their noble mission of providing shelter and revitalizing properties. He fearlessly confronts misconceptions, debunking the fallacy that Wall Street lords over 40% of homes, revealing their actual market presence of a mere 1-2%.

Carson regales viewers with a firsthand account of Wall Street's post-recession property acquisition spree, a game-changing move that birthed the trend of single-family rental communities. He boldly asserts that Wall Street's strategic shift may inadvertently benefit the market by expanding rental options and potentially lowering rents for the common folk. The narrative takes a dramatic turn as Carson delves into the disruptive impact of persistently low-interest rates on the housing sector, painting a bleak picture of a market plagued by stagnation and a dearth of entry-level housing options.

The stage is set for a showdown as Carson unveils startling statistics, revealing a drastic 40% drop in home transactions, akin to economic upheaval of epic proportions. Against this backdrop, he laments the record-low participation of first-time homebuyers, a mere 24% compared to the historical norm of 40%. The housing market's woes reverberate through the economy, posing challenges for aspiring homeowners and seasoned investors alike, underscoring the urgent need for a paradigm shift in the real estate landscape.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Real Estate Investors Caused the Housing Crisis! on Youtube

Viewer Reactions for Real Estate Investors Caused the Housing Crisis!

Viewers appreciate the insights and chemistry between the two content creators

Discussion on the potential shift from renting to selling properties

Concerns about high home insurance costs affecting homebuying decisions

Noting the financial struggles of many Americans and questioning who would buy homes without landlords

Success story of investing in a challenging neighborhood leading to increased property values

Compliments on the thumbnail of the video

Negative comment about Ryan Homes

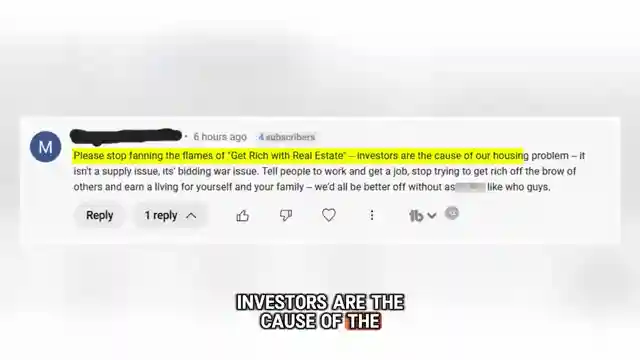

Criticism of investors for contributing to economic issues

Concerns about potential impact of changes to Section 8 housing assistance

Related Articles

Mastering Anti-Fragility in Real Estate: Strategies for Success

Coach Carson explores anti-fragility in real estate investing, advising on strategic cash reserves, debt management, and the power of small, flexible deals for long-term success.

DSCR Loans: Flexible Financing for Real Estate Investors

Discover the power of DSCR loans for real estate investors with Coach Carson and mortgage expert Brian Maddox. Learn how these flexible loans based on rental income can benefit self-employed individuals and foreign nationals, offering an alternative to traditional financing.

Top Real Estate Books: Millionaire Strategies, Survival Tactics & Expert Insights

Explore top real estate books: "The Millionaire Real Estate Investor," "The Real Estate Game," "Building Wealth One House at a Time," and more. Gain insights from millionaire investors, survival tactics, and expert strategies for intelligent decision-making in real estate.

Build the Rent Strategy: Navigating Rising Costs in Real Estate

Coach Carson explores the benefits of Build the Rent strategy, emphasizing the appeal of new properties in attracting top tenants and navigating rising costs in real estate investing.