Jamie York's 10-Year Property Investment Journey: From Diverse Strategies to Steady Returns

- Authors

- Published on

- Published on

On the riveting journey through property investment, Jamie York takes us on a rollercoaster ride of highs and lows. From buy-to-lets to rent-to-rents, developments to a South Dakota hotel - he's done it all. Jamie's no stranger to the game, having dabbled in flips and faced the harsh realities of unexpected costs and council roadblocks. But through it all, he's learned the value of passive income from property, citing capital growth and inflation as his trusty steeds in the race to wealth.

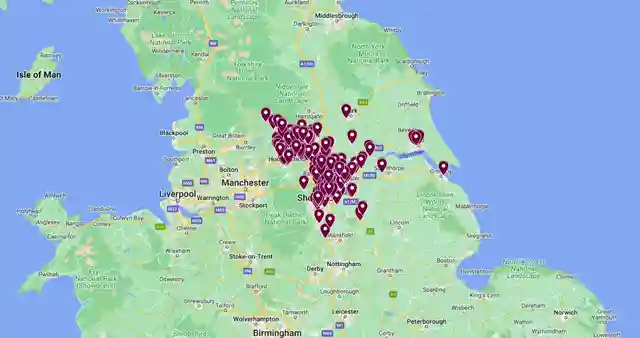

With the swagger of a seasoned investor, Jamie cuts through the noise to reveal his ultimate strategy - the "boring vanilla" buy-to-let portfolio. While others chase flashy service accommodations and hmos, Jamie opts for the steady, hands-off approach of buy-to-lets for long-term gains. He's a man who values tangible assets, preferring the solidity of property over the unpredictability of stocks. And with a portfolio pumping out a cool million pounds in new equity each year, who can blame him for sticking to what works?

But Jamie's not one to rest on his laurels. With an eye on the future, he sets his sights on a lofty goal - £100 million in assets over the next five years. It's not just about the numbers for Jamie; it's about creating homes and securing solid returns for his investors. And as he steers clear of the siren call of service accommodations, Jamie remains steadfast in his commitment to the fundamentals of property investment. So buckle up, folks, because with Jamie York at the wheel, the ride is bound to be thrilling, unpredictable, and ultimately, incredibly rewarding.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch I've got HOW MANY property investments?! on Youtube

Viewer Reactions for I've got HOW MANY property investments?!

Audience appreciates the openness and insights shared in the video

Request for more videos similar to this one

Interest in seeing more of Jamie's property portfolio

Request for a video on Jamie's big mistakes in property investment

Inquiry about Jamie's view on Hull as a Buy-to-Let area

Interest in investing in less popular areas for the team

Question about investing in North East vs. Yorkshire for beginners

Positive feedback on Jamie's openness and inspiration

Comment on the steady increase in property value over time

Encouragement and support for Jamie's success

Related Articles

Unlock Property Investment Funds: Leveraging Home Equity with Jamie York

Learn how to access funds for property investment by leveraging your home equity through remortgaging. Jamie York's expert tips can help you kickstart your investment journey in just 8 weeks, without the need for significant savings or windfalls. Accelerate your wealth-building with smart debt utilization.

UK Property Market Insights: Seizing Investment Opportunities in 2025

Jamie York explores the UK property market, discussing US trade tariffs, prime London property resurgence, immigration's impact, and the supply-demand imbalance. Learn how to seize investment opportunities in 2025 with Aspire Portfolio's hands-free property portfolio building services.

Property Wealth Journey: Leveraging Assets in Yorkshire

Jamie York shares his journey to property riches, emphasizing leveraging debt and tangible assets like property. Focusing on Yorkshire for affordability and capital growth, he targets properties below the area's average price for steady financial gains.

2025 Property Forecast: Seize Opportunities with Stabilized Prices and Dropping Interest Rates

Jamie York's property forecast highlights the 2025 market window with stabilized prices and dropping interest rates. Learn how to leverage this opportunity, manage finances with Lendlord, and build a successful property portfolio. Take action now in the thriving rental market!