Mastering Multifamily Investing: Tips for Transitioning from Single-Family Homes

- Authors

- Published on

- Published on

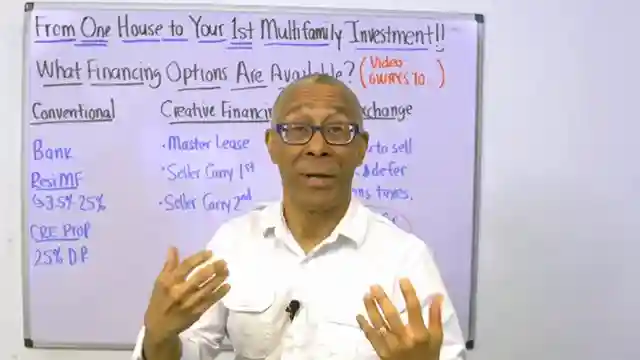

Today on Commercial Property Advisors, Peter Harris delves into the exhilarating world of transitioning from single-family homes to multifamily investing. He revs up the engines by emphasizing the importance of starting small, reminding viewers that it's perfectly acceptable to kick off their multifamily journey with a modest 4-unit or 12-unit property. Harris then shifts gears to discuss affordability, highlighting various financing options such as conventional lending, creative financing, and the adrenaline-pumping 1031 exchange.

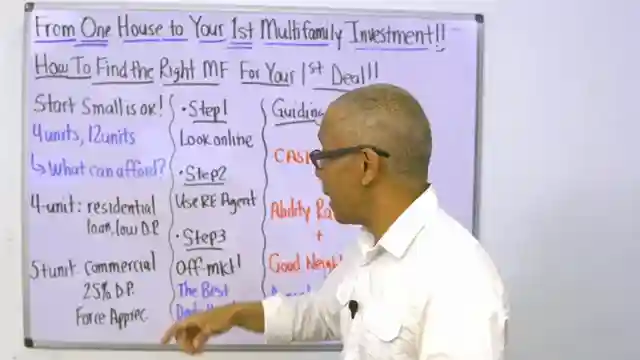

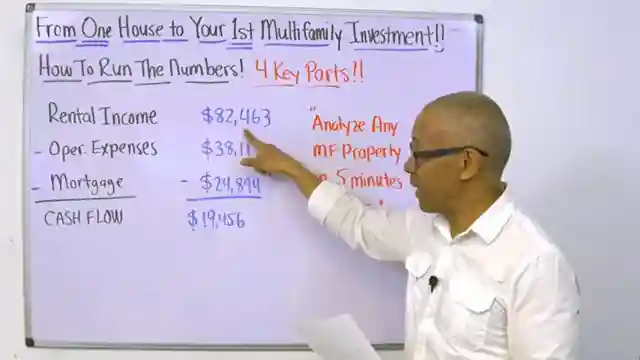

With the intensity of a high-speed race, Harris zooms through the process of finding the right multifamily property, urging viewers to explore online listings, engage real estate agents, or even go off-market for hidden gems. He provides viewers with a turbocharged set of guiding principles, stressing the need for cash flow positivity, rent increase potential, and the crucial factor of location when selecting properties. Harris's expert navigation through the intricate terrain of property analysis leaves viewers feeling equipped and ready to conquer the multifamily landscape with confidence.

As the episode accelerates towards the finish line, Harris unveils the four common pitfalls that can derail beginners in the multifamily investing circuit. With the precision of a seasoned race car driver, he warns against overpaying for properties, underestimating expenses, neglecting property management, and failing to plan for exit strategies. By the end of this adrenaline-fueled journey through the world of multifamily investing, viewers are left revved up and ready to hit the ground running on their path to financial success in the real estate arena.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch From 1 House to Your 1st Multifamily Investment on Youtube

Viewer Reactions for From 1 House to Your 1st Multifamily Investment

Importance of having a mentor for commercial real estate investing

Mention of a mentorship program for commercial property investors

Excitement about getting a first apartment building by a specific date

Related Articles

Mastering Multifamily Investments: Key Lessons for Success

Learn crucial multifamily property investment lessons from Commercial Property Advisors: prioritize cash flow and reserves, invest in top-notch property management, understand neighborhoods, start small, and take action over analysis paralysis for success in real estate.

Mastering Real Estate Funding: The 3 Essential Keys

Learn the three essential keys to effortlessly raising money for real estate deals from Commercial Property Advisors. Discover how to assess deal worthiness, position yourself attractively, and align opportunities with investor needs for successful funding.

Maximize Wealth: Why Choose Commercial Real Estate Over Stocks

Discover why Commercial Property Advisors recommends commercial real estate over stocks. Learn about predictability, cash flow, leverage, tax benefits, and building a lasting legacy through tangible assets. Gain control and stability in wealth-building today.

From Layoff to Real Estate Tycoon: Jaden's $14M Success Story

Follow Jaden's inspiring journey from corporate layoff to owning $14 million in multifamily properties. Learn how strategic investing and perseverance led to his success in commercial real estate.