Maximize Wealth: Smart Investing Tips with Aspire Portfolio

- Authors

- Published on

- Published on

In this thrilling episode, the team delves into the exhilarating world of smart investing, leaving behind the mundane pursuit of quick cash for the adrenaline-pumping rush of long-term wealth building. They reveal the secret to avoiding the dreaded investor's block that plagues many, urging viewers to focus on selecting high-growth areas like the legendary Vine Street properties. By strategically timing when to extract profits and when to let properties appreciate, they showcase how to turbocharge your investment portfolio for maximum returns.

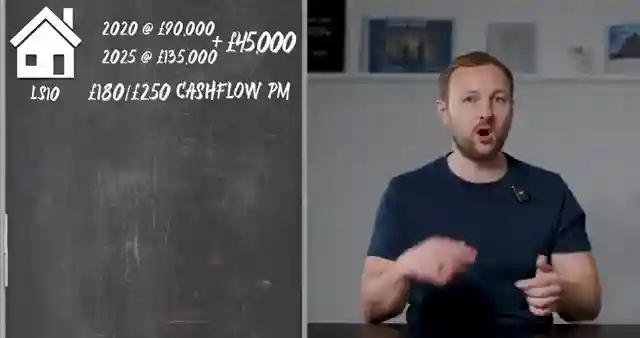

With the precision of a Formula 1 pit crew, the team shares heart-pounding examples of properties skyrocketing in value over a mere five-year span, allowing them to cash out hefty sums for further conquests in the property market. They caution against the reckless strategy of haphazardly acquiring properties, advocating instead for a well-thought-out plan where each investment fuels the next in a high-octane chain reaction of financial success. The importance of starting with the basics, the "boring vanilla berlet properties," before attempting the high-speed maneuvers of advanced investment strategies is emphasized, ensuring a solid foundation for future growth.

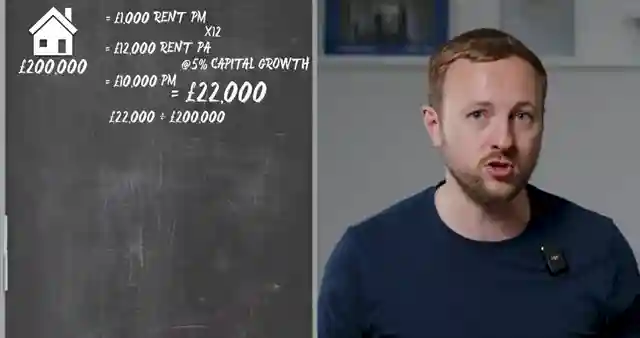

Like a skilled race car driver navigating treacherous terrain, the team demonstrates the art of leveraging debt to propel your investments forward without spinning out of control. By expertly balancing risk and reward, they show how to multiply your gains by investing in multiple properties with calculated leverage, all while avoiding the pitfalls of overextending yourself. As the engines roar and the excitement builds, viewers are invited to join the action-packed journey of building a robust investment portfolio with the guidance and support of Aspire Portfolio. Buckle up, hit the gas, and accelerate towards your financial goals with the adrenaline-fueled strategies shared in this electrifying episode.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Most PROPERTY INVESTORS run out of money... Here's why you WON'T! on Youtube

Viewer Reactions for Most PROPERTY INVESTORS run out of money... Here's why you WON'T!

Discussion about voids in Buy to Let properties

Related Articles

Unlock Property Investment Funds: Leveraging Home Equity with Jamie York

Learn how to access funds for property investment by leveraging your home equity through remortgaging. Jamie York's expert tips can help you kickstart your investment journey in just 8 weeks, without the need for significant savings or windfalls. Accelerate your wealth-building with smart debt utilization.

UK Property Market Insights: Seizing Investment Opportunities in 2025

Jamie York explores the UK property market, discussing US trade tariffs, prime London property resurgence, immigration's impact, and the supply-demand imbalance. Learn how to seize investment opportunities in 2025 with Aspire Portfolio's hands-free property portfolio building services.

Property Wealth Journey: Leveraging Assets in Yorkshire

Jamie York shares his journey to property riches, emphasizing leveraging debt and tangible assets like property. Focusing on Yorkshire for affordability and capital growth, he targets properties below the area's average price for steady financial gains.

2025 Property Forecast: Seize Opportunities with Stabilized Prices and Dropping Interest Rates

Jamie York's property forecast highlights the 2025 market window with stabilized prices and dropping interest rates. Learn how to leverage this opportunity, manage finances with Lendlord, and build a successful property portfolio. Take action now in the thriving rental market!