Navigating the Homeowners Insurance Crisis in America: California's Challenges

- Authors

- Published on

- Published on

Reventure Consulting delves into the chaotic realm of homeowners insurance in America, with California at the heart of the storm. A tempest of denial leaves many homeowners stranded without coverage in the aftermath of devastating fires. The surge in insurance costs, climbing double digits annually, has left over 10 million Americans in the perilous position of going bare. This crisis is not just a blip on the radar; it's a tidal wave crashing down on the housing market, with values plummeting in high-cost insurance states like Florida, Louisiana, and Texas.

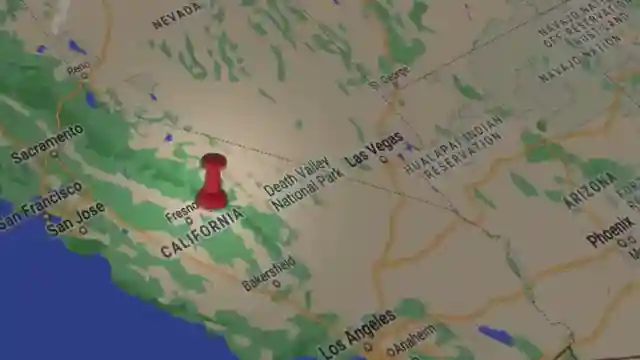

California's regulatory maze, designed to keep insurance premiums in check, has backfired spectacularly. By prohibiting insurers from factoring in reinsurance costs, the state has inadvertently pushed insurers out the door, leaving homeowners high and dry. The Golden State's attempt to shield consumers has instead left them exposed to gaping coverage holes, especially concerning wildfire risks. The burning question remains: should the government intervene to prop up homeowners in disaster-prone regions, or is the concept of homeowners insurance itself up in smoke in certain parts of America?

Looking ahead to 2025, the crystal ball reveals a bleak forecast for homeowners insurance costs, particularly in California and Florida. Deregulation efforts in the former are set to ignite premiums, while the latter continues to reel from the aftermath of hurricanes, with insurance costs soaring to exorbitant heights. Homebuyers are urged to navigate these treacherous waters with caution, seeking wisdom from multiple insurance brokers before making a housing plunge. The landscape is shifting, and the once-stable foundations of the housing market are trembling under the weight of insurance uncertainty.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch State Farm canceling policies. US Housing Market on verge of insurance crisis. on Youtube

Viewer Reactions for State Farm canceling policies. US Housing Market on verge of insurance crisis.

Warning to homebuyers: get multiple quotes from insurance brokers and understand coverage

Consider owning real estate in disaster-prone areas with increasing insurance costs

Economy grappling with uncertainties affecting housing, foreclosures, global fluctuations

Rising inflation, sluggish growth, and trade disruptions demand attention

Insurance costs vary significantly by location, with some experiencing drastic increases

Concerns about affordability leading to people leaving California

Questions about the fairness and justification of high insurance costs

Impact of insurance companies' profit motives on consumers

Changes in mortgage rates over time and implications for homeowners

Challenges with insurance coverage and costs in disaster-prone areas

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.