Real Estate Showdown: 10 Single Family Rentals vs. 1 Multifamily Property

- Authors

- Published on

- Published on

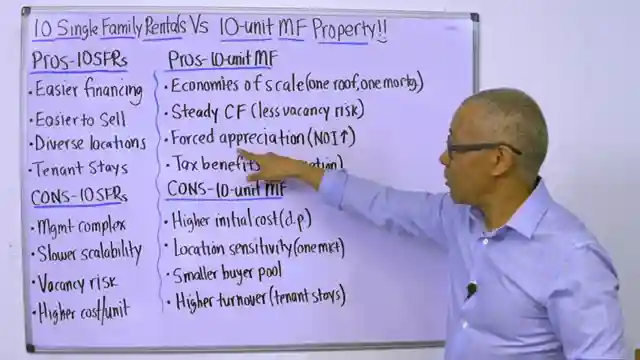

Today on Commercial Property Advisors, the age-old question of real estate investment is put to the test: Should you go for 10 single family rentals or one 10-unit multifamily property? Peter Harris takes us on a journey through the pros and cons of each option. Single family homes offer financing ease and diversification, but managing multiple entities and facing higher costs per unit can be a challenge. On the flip side, a 10-unit multifamily property boasts economies of scale, steady cash flow, and impressive tax benefits. Despite initial costs and location sensitivity, multifamily properties emerge as the more efficient choice.

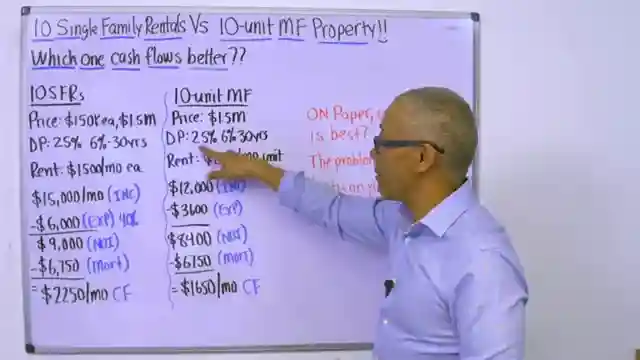

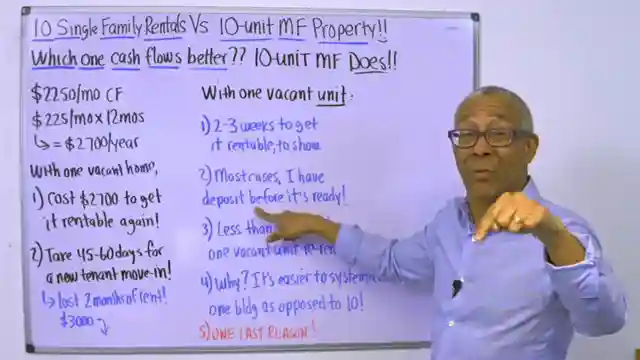

When it comes to cash flow comparison, single family rentals may seem more lucrative on paper, but the practicality of multifamily properties shines through in the long run. Efficiency in turnover and maintenance sets multifamily investments apart, offering quicker rentability and reduced downtime. Harris shares his personal journey of transitioning from single family rentals to multifamily properties to streamline operations and minimize headaches. The superior tax benefits of multifamily properties, including enhanced depreciation and cost segregation benefits, further solidify their position as a top choice for savvy investors.

In conclusion, the debate between single family rentals and multifamily properties is settled in favor of the latter. The efficiency, scalability, and profitability of multifamily investments make them the clear winner in the realm of real estate. Harris's expert analysis and real-world examples showcase the undeniable advantages of multifamily properties over single family rentals. For investors seeking long-term success and financial freedom, the choice is clear: go big with a 10-unit multifamily property and reap the rewards of a smart and strategic investment strategy.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch 10 Single Family Rentals vs 10 Unit Multifamily Property on Youtube

Viewer Reactions for 10 Single Family Rentals vs 10 Unit Multifamily Property

Mentoring program offered by Commercial Property Advisors

Interest in investing in multi-family units in different states

Question about whether cash flow or appreciation is the end goal in real estate investing

Inquiry about purchasing first 8-10 unit property and seeking mentorship

Comparison between building a new apartment complex or buying an existing one

Related Articles

Mastering Multifamily Investments: Key Lessons for Success

Learn crucial multifamily property investment lessons from Commercial Property Advisors: prioritize cash flow and reserves, invest in top-notch property management, understand neighborhoods, start small, and take action over analysis paralysis for success in real estate.

Mastering Real Estate Funding: The 3 Essential Keys

Learn the three essential keys to effortlessly raising money for real estate deals from Commercial Property Advisors. Discover how to assess deal worthiness, position yourself attractively, and align opportunities with investor needs for successful funding.

Maximize Wealth: Why Choose Commercial Real Estate Over Stocks

Discover why Commercial Property Advisors recommends commercial real estate over stocks. Learn about predictability, cash flow, leverage, tax benefits, and building a lasting legacy through tangible assets. Gain control and stability in wealth-building today.

From Layoff to Real Estate Tycoon: Jaden's $14M Success Story

Follow Jaden's inspiring journey from corporate layoff to owning $14 million in multifamily properties. Learn how strategic investing and perseverance led to his success in commercial real estate.