Student Debt Default Crisis: Impact on Borrowers and Housing Market

- Authors

- Published on

- Published on

In this thrilling episode by Reventure Consulting, the New York Federal Reserve drops a bombshell, revealing a staggering 15% default rate on student debt, affecting a whopping 9 million borrowers. Despite a 5-year breather from interest payments, the government now demands repayment, putting borrowers' credit scores at risk. Imagine going from a pristine 760 to a dismal 590, locking you out of buying a house or car at reasonable rates. It's a financial nightmare that could send shockwaves through the economy, especially since many struggling with student debt are actually high-income earners.

Meanwhile, enter Open Door, the Wall Street giant facing losses on properties, causing ripples in home values across communities. The housing market is in turmoil, with prices plummeting and inventory levels soaring, painting a grim picture of potential distress. The government's attempts to stave off economic woes post-pandemic seem futile as foreclosures and defaults rear their ugly heads. Student loan borrowers, lulled by the interest-free pandemic era, now face the harsh reality of credit score repercussions due to missed payments.

As the dust settles, it's evident that 9 million Americans are staring at credit score drops of up to 150 points, a bitter pill to swallow for those trapped in the student debt quagmire. The housing market echoes this turmoil, with increasing rental listings and hidden MLS entries hinting at a market slowdown and impending price dips. To navigate these treacherous waters, tools like Reventure App offer vital insights into home values and inventory trends, empowering users to make informed decisions in this turbulent financial landscape.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Student loan defaults skyrocket to 15%. (it’s about to get worse) on Youtube

Viewer Reactions for Student loan defaults skyrocket to 15%. (it’s about to get worse)

9 million student loan borrowers currently in default

Impact of missed payments on credit scores

Spillover impact on the housing market

Concerns about high tension power lines near the neighborhood

Comments on the housing prices and lack of landscaping

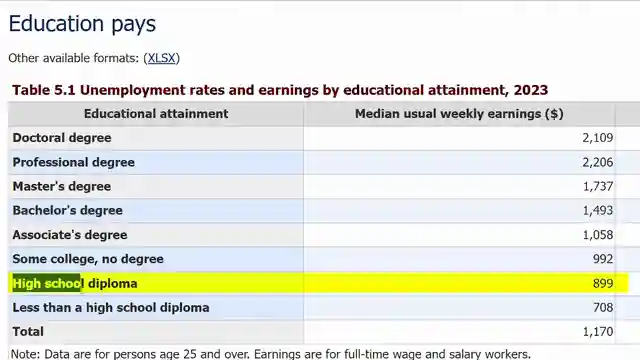

Differences between average and median salaries for college graduates

Warnings about the current economic situation and potential crash

Personal stories and experiences with student loans

Criticisms of the education system and student loan debt

Calls for accountability and repayment of debts

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.