US Home Buyer Demand Plummets: Housing Market Bubble Looms

- Authors

- Published on

- Published on

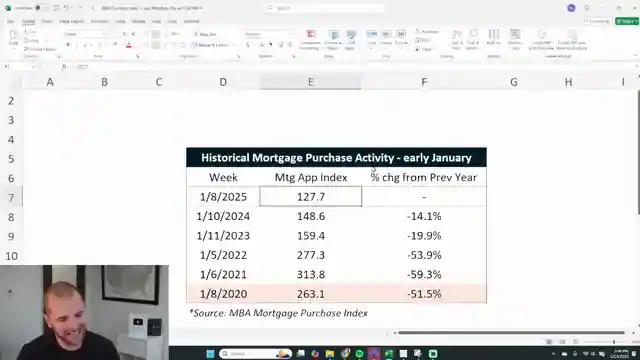

Reventure Consulting reveals a staggering drop in US home buyer demand, sending shockwaves through the housing market. Mortgage applications have nosedived by a whopping 63% from their pandemic peak, painting a grim picture of empty open houses and slashed prices ahead. Despite some initial price dips in certain states, the overall housing market remains perched on the edge of the biggest bubble in history. The Federal Reserve's attempts to lower mortgage rates have backfired spectacularly, with rates soaring to 7.26%, leaving buyers high and dry.

This economic rollercoaster has left the Fed seemingly powerless, as interest rates spiral out of control, defying all predictions. Mortgage applications are plummeting compared to previous years, leading to a surge in the number of days houses languish on the market, notably in states like Florida. The once red-hot price growth is cooling off, with some markets even witnessing negative growth. Americans now require a staggering annual income of $110,000 to even think about qualifying for a mortgage, highlighting the stark lack of affordability plaguing the housing sector.

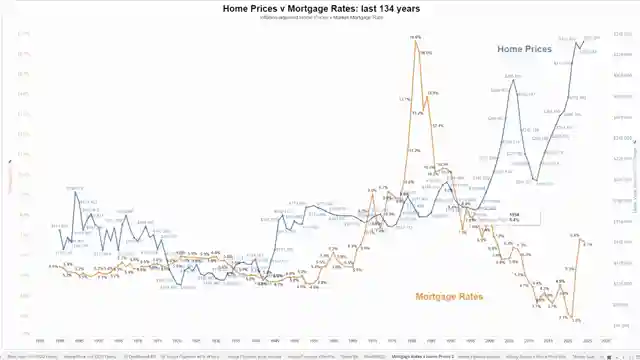

The prevailing sentiment in the housing market is one of pessimism, with a majority of Americans deeming it a bad time to buy due to exorbitant prices. Historical data underscores the gravity of the situation, showing that home prices, adjusted for inflation, have skyrocketed to unprecedented levels. While income growth may offer some respite in 2025, the real salvation lies in plummeting prices rather than wage hikes. Reventure Consulting's forecasts paint a bleak picture for states like Florida, Texas, and Colorado, where supply-demand dynamics are tilting in favor of buyers. However, caution is advised, as neighborhood-level disparities can significantly impact price trajectories.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Biggest mortgage collapse in US History just got worse. on Youtube

Viewer Reactions for Biggest mortgage collapse in US History just got worse.

Homebuyer demand is down in early 2025, with mortgage applications significantly lower than previous years.

Some users are considering switching from real estate to stocks due to market conditions.

Concerns about high mortgage rates and the impact on retirement savings.

Speculation on the future of interest rates and their effect on the housing market.

Observations on the historical context of mortgage rates and home prices.

Discussion on the affordability of housing and the challenges faced by first-time buyers.

Predictions about potential housing market crashes and strategies for investment.

Comments on the impact of interest rates on the housing market and the economy.

Concerns about the sustainability of current housing market trends and construction costs.

Criticisms of market manipulation and inflated prices in the housing sector.

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.