Navigating Mortgage Rate Fluctuations: Expert Insights and Predictions

- Authors

- Published on

- Published on

In the tumultuous world of mortgage rates, the numbers have taken a thrilling plunge from 7.25% to 6.75%, leaving real estate enthusiasts on the edge of their seats, wondering: will rates plummet further or is this just a fleeting respite before they soar once more? Dave, the real estate guru at BiggerPockets, delves into the heart-pounding saga of rate predictions. With insights from the esteemed analyst Logan Mesami, the stage is set for a riveting showdown between economic data and investor confidence.

Logan's crystal ball reveals a landscape where economic softness reigns supreme, nudging yields downwards and sending mortgage rates on a dizzying descent. The 10-year yield's dance between 3.8% and 4.7% hints at a potential rate bonanza if economic woes deepen. But hold onto your hats, folks, because Logan warns that this rate rollercoaster might require a stock market selloff to truly plunge into the depths of lower rates. The plot thickens as economic signals play a game of cat and mouse, leaving investors teetering on the edge of their seats.

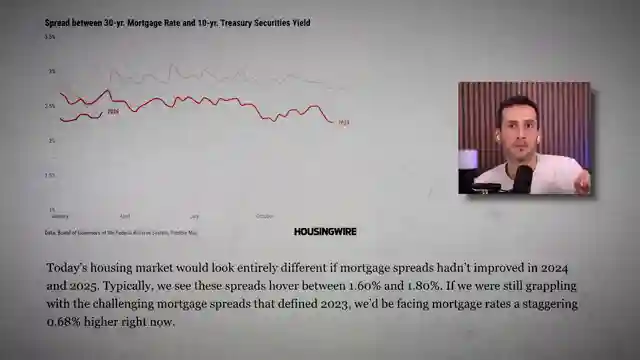

Meanwhile, the spread between bond yields and mortgage rates adds another layer of intrigue to this high-stakes drama. Historically hovering around 1.9%, this spread has seen its fair share of twists and turns, mirroring the market's tumultuous journey. Logan's forecast of a modest spread improvement opens the door to tantalizing possibilities of even lower rates. As the real estate community braces for impact, the question lingers: will rates plummet to 5.75%, offering a lifeline to eager investors, or will economic winds shift, leaving them stranded in a sea of uncertainty?

In this adrenaline-fueled race against time, Dave's sage advice cuts through the noise, urging investors to focus on the present moment rather than chasing elusive future predictions. With the real estate market's resilience in the face of fluctuating rates, the key to success lies in seizing the opportunities that exist today, rather than waiting for an uncertain tomorrow. As the curtain falls on this thrilling episode of rate revelations, one thing remains clear: in the unpredictable world of real estate, only those bold enough to take the plunge will emerge victorious.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Mortgage Rates Fall to 2025 Lows, Could They Dip Below 6%? on Youtube

Viewer Reactions for Mortgage Rates Fall to 2025 Lows, Could They Dip Below 6%?

People are discussing interest rates and their fluctuations

Reference to a quote from "The Wolf of Wall Street"

Speculation on the future of interest rates

Concerns about negative GDP growth and potential recession

Comments on the current market being a bear interest rate market

Questions about high interest rates and seeking advice

Mention of wearing AirPods

Criticism of fake laughs in the video

Confusion and uncertainty about the topic discussed in the video

Appreciation for the content and knowledge shared in the video

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.