Mastering Rental Property Acquisition: BiggerPockets Strategies

- Authors

- Published on

- Published on

In this riveting episode by BiggerPockets, the team delves into the exhilarating world of acquiring five rental properties in just five years. A feat that can truly revolutionize one's financial future. The challenge of securing multiple properties within a short timeframe, especially amidst soaring housing prices, may seem daunting to the average investor. However, fear not, for the team unveils three dynamic strategies to help you secure one rental property each year for the next five years, setting you on a thrilling path towards financial liberation.

The adrenaline-pumping journey kicks off with the classic owner-occupied house hacking strategy. This ingenious approach involves living in one unit of a rental property while renting out the others, offering a gateway to financial freedom with minimal down payments and invaluable learning opportunities. By strategically reducing living expenses through house hacking, investors can amass savings for subsequent property acquisitions, propelling them closer to their goal of five properties in five years. The team illustrates this strategy with a compelling example of purchasing a duplex for $300,000, showcasing the potential for significant savings and rental income through calculated investment maneuvers.

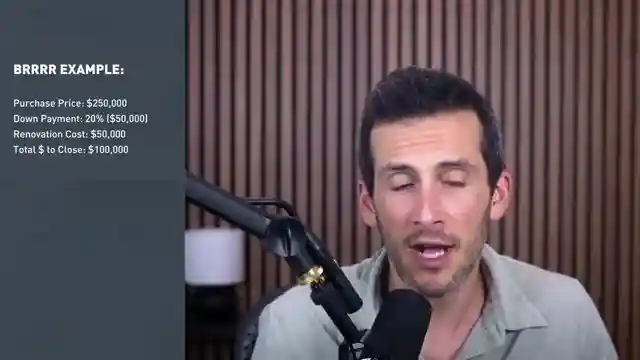

Next up on this electrifying ride is the renowned Burr method, a high-octane approach that combines the thrill of property flipping with the long-term benefits of rental income. Standing for buy, rehab, rent, refinance, and repeat, the Burr method empowers investors to unlock the hidden potential of undervalued properties through strategic renovations, subsequently boosting property values and generating rental income. Despite naysayers questioning the efficacy of the Burr method, the team stands firm in its belief in the enduring success of this strategy, highlighting its capacity to propel investors towards acquiring multiple properties within a compressed timeframe. An exhilarating example is presented, illustrating how a property purchased for $250,000 and renovated for $50,000 can be refinanced at a higher value, enabling investors to extract equity and fuel their property acquisition journey.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How to Buy 5 Rental Properties in Just 5 Years on Youtube

Viewer Reactions for How to Buy 5 Rental Properties in Just 5 Years

Buying properties with low down payments and utilizing cash flow for further investments

Snowball method for purchasing properties debt-free

Challenges in finding affordable properties in certain areas

Questions about interest rates and loan options

Concerns about underestimating additional expenses of homeownership

Request for examples and clarification on investment strategies

Difficulty in finding tenants for rental properties

Doubts about the feasibility of achieving certain financial goals in real estate

Skepticism about the feasibility of certain investment scenarios

Seeking advice on investment strategies and overcoming challenges in real estate.

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.