Navigating the Renting vs. Buying Dilemma: Ken McElroy's Insights

- Authors

- Published on

- Published on

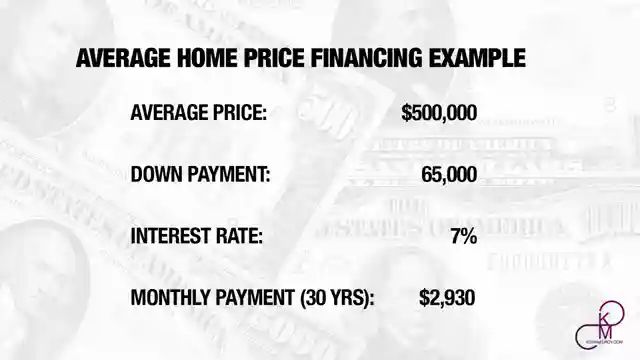

In this episode of Ken McElroy's show, the discussion revolves around the eternal dilemma of renting versus buying a home. With soaring home prices in cities like Austin, Seattle, and Phoenix, the affordability gap between renting and buying has widened significantly. McElroy sheds light on the oversupply issues in markets like Austin, leading to stagnant rents and enticing concessions for tenants. He points out the tough competition faced by independent homeowners trying to sell their properties against new home builders offering irresistible rates. The key takeaway is the strategic advantage of investing during periods of rent softness and minimal rent growth, ensuring a profitable venture in the long term.

McElroy predicts a continued upward trajectory in home prices, making ownership a more financially rewarding choice over time. He emphasizes the critical need to secure renters amidst a softening rental market to maintain a steady income stream. Additionally, he discusses the pivotal role of low mortgage rates in stimulating new construction and revitalizing the housing sector. McElroy's insights underscore the importance of seizing opportunities during times of rent stagnation and subdued rent increases. He also highlights the impact of competitive rental rates on the decision-making process between renting and buying, urging viewers to consider the long-term financial implications of their choices.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Renting vs. Buying: Here's Why It's Not Even Close on Youtube

Viewer Reactions for Renting vs. Buying: Here's Why It's Not Even Close

Considerations between buying and renting a home, including financial aspects and long-term investments

The importance of ongoing expenses such as maintenance, insurance, and taxes in homeownership

Real estate market trends in different regions, such as falling prices in Texas and Florida

Factors to consider before buying a home, such as the need for equity for future expenses like roof repairs and appliances

Discussion on the disparity between wage growth and the increasing costs of living, including housing

Strategies for maximizing returns, such as renting in one location and buying in another with better returns

The impact of local market conditions on real estate decisions

Critiques on the financial benefits of buying a home in the current market, with arguments for renting and investing the difference

Insights on the long-term benefits of homeownership, especially in desirable areas

Criticisms of the real estate industry's focus on profits and the impact on individuals struggling with housing issues

Related Articles

Navigating Economic Uncertainties: Insights from Ken McElroy

Ken McElroy discusses the economy's dire state, the impact of national debt, and the importance of tangible assets like gold and Bitcoin for financial stability. Attendees are urged to gain insights at the upcoming Limitless event for navigating economic uncertainties.

Ken McElroy: Board Games for Financial Success & Investing Insights

Ken McElroy advocates using board games to teach practical skills like real estate and sales for financial success. He warns against investing in bonds, promotes hard assets, and discusses the impact of automation on job markets. Join the Limitless event for expert insights!

The Truth About Rising Homeownership Costs: A Market Analysis

Ken McElroy exposes the hidden costs of homeownership surpassing $18,000 yearly before mortgages. Rising expenses, supply shortages, and high demand are reshaping the housing market, pushing many towards renting. Policy changes may offer relief, but for now, owning a home remains a luxury.

Ken McElroy Explains Why $1 Detroit Homes Were Not Worth It

Ken McElroy shares insights on why he passed on $1 homes in Detroit due to hidden costs, neighborhood issues, and the importance of focusing on fundamentals in real estate investing.