The Truth About Rising Homeownership Costs: A Market Analysis

- Authors

- Published on

- Published on

In this explosive video from Ken McElroy, the housing market is dissected like a juicy steak. He reveals the dirty secrets of homeownership costs, which soar over $18,000 annually before even thinking about your mortgage. It's a financial minefield out there, folks. While rents are chilling out or even dropping in some places, owning a home is like signing up for a lifetime of financial servitude. McElroy pulls back the curtain on property taxes, insurance, maintenance, and those pesky HOAs that bleed your bank account dry. It's a real eye-opener for anyone dreaming of a white picket fence.

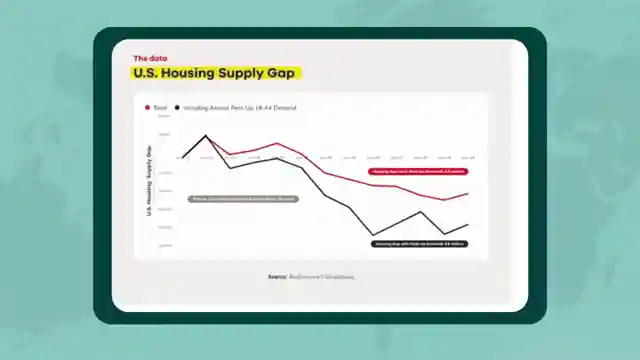

So, what's causing this housing hellscape? Well, brace yourself for skyrocketing mortgage rates, insurance premiums shooting up like fireworks, and local taxes rising faster than a SpaceX rocket. And good luck finding a contractor for maintenance - if you do, be prepared to fork over double the cash. Builders are slapping on band-aids with rate buy-downs and incentives, but the market's still on life support. With supply down almost 45% from the norm, more folks are opting to rent because buying a home is about as realistic as a unicorn sighting. It's a vicious cycle of artificial scarcity that's keeping prices high and dreams of homeownership out of reach.

As if that weren't enough, the housing market is playing a cruel game of cat and mouse with young people. First-time buyers need a small fortune just to get a foot in the door, while families are fleeing high-cost states like rats on a sinking ship. Airbnb investors are ditching their properties faster than you can say "cash flow," thanks to inflation throwing a spanner in the works. The millennials and Gen Z crew are left out in the cold, watching the American dream of homeownership slip through their fingers like sand. Even Airbnb, once the golden goose of real estate, is feeling the squeeze as prices drop and vacancies rise. It's a tough pill to swallow, but the era of owning a home as a birthright is fading fast.

Looking ahead to 2025 and 2026, McElroy predicts a bumpy ride. Inflation is here to stay, and the housing market is in for a wild rollercoaster. Boomers are downsizing faster than you can say "empty nest," while millennials and Gen Z are stuck in a renter's purgatory. Policy changes may be on the horizon, with whispers of 40-year mortgages and land leases floating in the air. But until those changes kick in, owning a home will be the exception, not the rule. It's a landlord's paradise in the making, with rent prices set to soar as more folks are priced out of the homeownership game. While the housing market may see some turbulence, one thing's for sure - home prices are heading for the stars, leaving many scrambling to find a foothold in an increasingly unaffordable market.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Is Buying a Home in 2025 Financial Suicide on Youtube

Viewer Reactions for Is Buying a Home in 2025 Financial Suicide

Buying property as an investment

Retiring early through good investments

Concerns about the luxury of homeownership

Impact of private equities on real estate

Managing insurance across properties

Potential job loss due to AI integration

Criticism of Air BNB compared to hotels

Use of "buy now pay later" services on groceries

Criticism of extending loan terms

Smart decisions in renting versus buying due to FOMO trends

Related Articles

Navigating Economic Uncertainties: Insights from Ken McElroy

Ken McElroy discusses the economy's dire state, the impact of national debt, and the importance of tangible assets like gold and Bitcoin for financial stability. Attendees are urged to gain insights at the upcoming Limitless event for navigating economic uncertainties.

Ken McElroy: Board Games for Financial Success & Investing Insights

Ken McElroy advocates using board games to teach practical skills like real estate and sales for financial success. He warns against investing in bonds, promotes hard assets, and discusses the impact of automation on job markets. Join the Limitless event for expert insights!

The Truth About Rising Homeownership Costs: A Market Analysis

Ken McElroy exposes the hidden costs of homeownership surpassing $18,000 yearly before mortgages. Rising expenses, supply shortages, and high demand are reshaping the housing market, pushing many towards renting. Policy changes may offer relief, but for now, owning a home remains a luxury.

Ken McElroy Explains Why $1 Detroit Homes Were Not Worth It

Ken McElroy shares insights on why he passed on $1 homes in Detroit due to hidden costs, neighborhood issues, and the importance of focusing on fundamentals in real estate investing.