Trump's Tariffs: Economic Impact and Housing Market Trends

- Authors

- Published on

- Published on

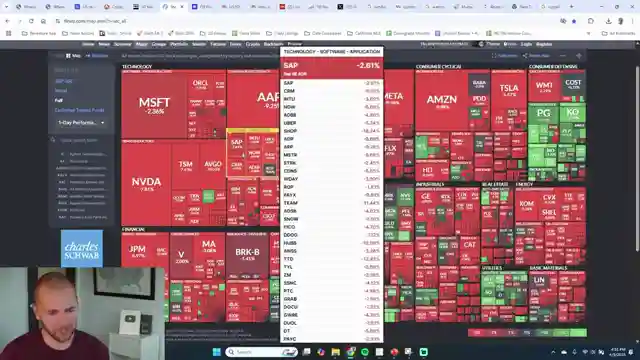

In a world where Trump's tariffs are shaking up the American economy, Reventure Consulting dives deep into the chaos. With the average tariff rate skyrocketing to 23%, the highest in over a century, the financial landscape is trembling. Stock prices are plummeting, bond yields are on a downward spiral, and whispers of a looming recession grow louder. The impact is hitting hard on consumer goods like apparel, food, and cars, with prices expected to soar. Countries like China, the EU, and Vietnam are facing hefty reciprocal tariffs, painting a grim picture of the global trade war.

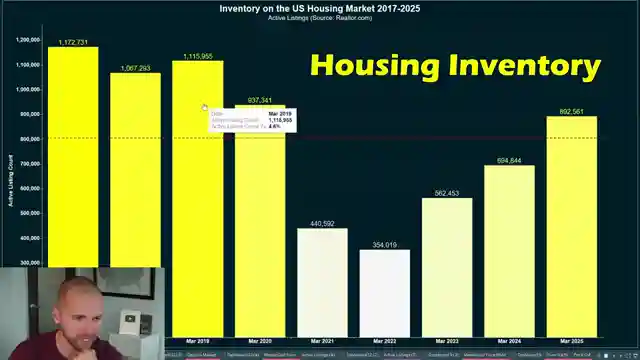

As the dust settles, uncertainty looms large as Trump's wavering stance on negotiations adds a twist to the tale. The potential repercussions on everyday consumers are daunting, with the specter of rising prices hanging over their heads. Surprisingly, despite expectations of inflation, commodity prices, including oil and lumber, take a nosedive, hinting at a deflationary trend. Treasury yields and mortgage rates follow suit, painting a bleak picture of economic slowdown and a possible recession on the horizon. The housing market echoes this sentiment, witnessing a surge in inventory and price cuts, especially in states like Colorado, Texas, and Florida.

Amidst the chaos, the stock market reels from the tariff news, with major indices taking a hit and fears of an economic downturn gripping investors. Baby boomers, holding the reins of both housing stock and stock market wealth, may soon enter the selling fray due to escalating market uncertainties. Looking ahead, the long-term effects of tariffs could trigger significant geographic shifts in the US, reshaping the housing market landscape. States like Michigan, Indiana, and Ohio stand to gain from potential job onshoring, while auto manufacturing hubs in the Midwest and southern states could see a revival if demand for US-made vehicles surges. The Midwest emerges as a dark horse, poised to become a housing market powerhouse over the next decade, fueled by affordability and economic growth prospects. Reventure Consulting offers a lifeline in these turbulent times, urging viewers to track the impact of Trump's tariffs on local housing markets through their app, providing crucial insights for strategic real estate investments at an accessible price point.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch This has never happened before…. on Youtube

Viewer Reactions for This has never happened before….

Concerns about the impact of tariffs on the economy and prices

Speculation on the possibility of a recession

Discussion on historical events related to tariffs and economic downturns

Comments on the potential effects of tariffs on different industries

Debate on the necessity of a recession and deflation

Criticism of Trump's tariff policies

Observations on the behavior of businesses in response to tariffs

Analysis of oil prices in relation to economic expectations

Comments on the impact of tariffs on international trade and competitiveness

Personal anecdotes and experiences related to the topic

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.