Mastering LLC Protection: Wyoming Strategies & Asset Shielding

- Authors

- Published on

- Published on

In this riveting episode by Clint Coons Esq., the importance of setting up your LLC properly for maximum protection is laid bare. The stakes are high, with countless investors falling victim to legal pitfalls due to improper structuring. Clint reveals a tale of woe where an investor's LLC failed to shield him from a ruthless creditor, resulting in financial ruin. The message is clear: without the right information and expert guidance, your LLC could crumble like a house of cards in the face of legal onslaught.

The crux of the matter lies in understanding the two-headed beast of liability: asset liability and personal liability. Clint delves deep into the intricacies, highlighting scenarios where your assets or personal actions can land you in legal hot water. To combat this, a two-tier approach is proposed, involving the creation of an asset liability entity and a strategic separation of personal liability. Enter Wyoming, Nevada, and Delaware, the triumvirate of states offering top-tier asset protection through specific legal statutes.

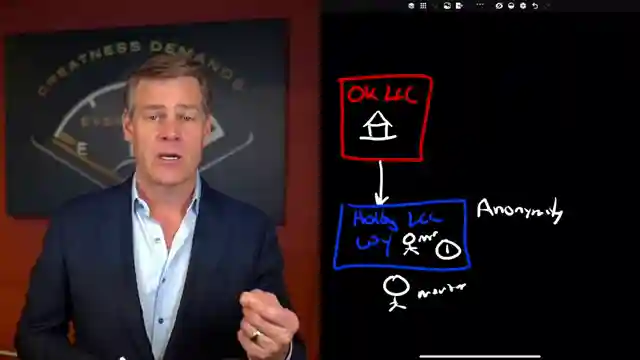

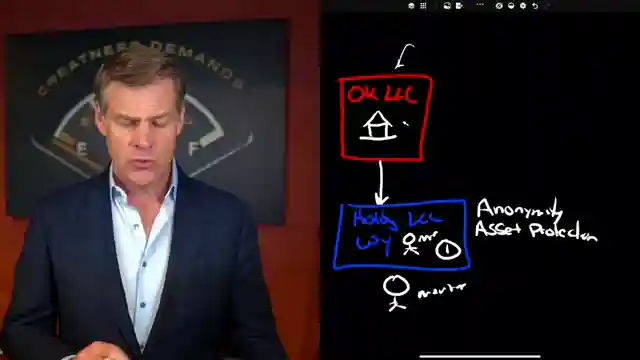

The pièce de résistance in Clint's arsenal is the Wyoming LLC, a bastion of anonymity and asset protection. By shrouding your ownership details in secrecy, this LLC becomes an impenetrable fortress against prying eyes and voracious creditors. The key lies in member-managed LLCs, where the Wyoming entity acts as the silent guardian, shielding your assets from the storm of personal liabilities. And let's not forget the crucial role of EINs in fortifying your LLC's defenses, ensuring that no legal adversary can breach your financial defenses.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Here's How To Set Up Your LLC For Maximum Protection In 2025 on Youtube

Viewer Reactions for Here's How To Set Up Your LLC For Maximum Protection In 2025

Setting up an LLC

Different types of LLCs (Grantor, Trustee, Beneficiary)

Manager-managed LLCs

Distribution discretion in operating agreements

Assigning interests in an LLC to a holding LLC

Potential piercing of the veil in legal situations

Partnerships in California LLCs

Managing properties directly

Coordinating repairs via personal email and phone

Payments made from the LLC account

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.