Ultimate Guide to Real Estate Millionaire: BiggerPockets Strategy

- Authors

- Published on

- Published on

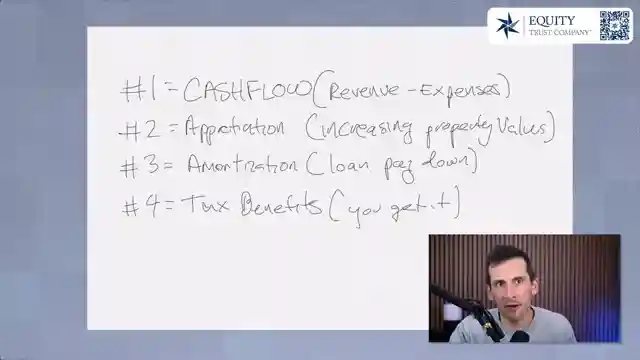

In this thrilling episode of BiggerPockets, the path to becoming a real estate millionaire is laid out with the precision of a seasoned race car driver navigating a challenging track. The four essential pillars of wealth building in real estate are dissected: cash flow, appreciation, amortization, and taxes. Cash flow, the roaring engine of real estate success, propels investors towards financial freedom by subtracting all expenses from revenue, leaving a trail of profit in its wake. Appreciation, akin to the turbo boost in a high-performance vehicle, sees property values surge over time, adding significant value to the investor's portfolio.

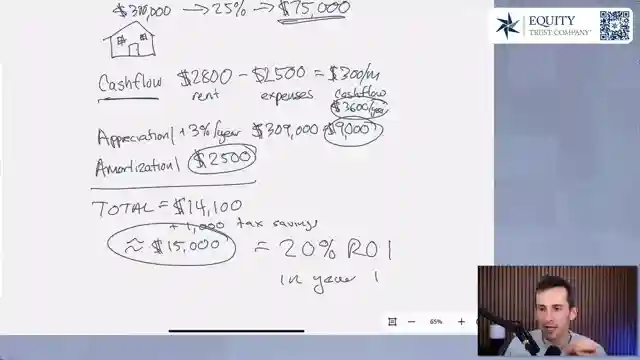

Amortization, often overlooked like a hidden gem on the racetrack, involves paying down a loan using rental income, providing a steady and reliable annual return. The tax benefits, akin to a skilled pit crew fine-tuning a racing machine, allow real estate investors to retain more of their hard-earned cash, thanks to the favorable US tax code. These elements harmonize in the world of real estate investing, creating a symphony of wealth-building opportunities that set this asset class apart from the rest. The video then plunges into a thrilling example, where a $75,000 investment in a $300,000 property accelerates towards a $15,000 return in the first year, showcasing a remarkable 20% return on investment.

As the journey unfolds, the video delves into strategies for scaling this financial engine to surpass the coveted million-dollar net worth mark. In the second year, with rent increases, appreciation gains, and growing amortization, the investor's total return on investment revs up to nearly $17,000, highlighting the exhilarating potential for financial growth through strategic real estate investing. Just like a high-speed race, real estate investing demands skill, strategy, and a thirst for victory, offering investors the opportunity to navigate towards the checkered flag of financial success with speed and precision.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How to Become a Millionaire Through Real Estate (Beginners!) on Youtube

Viewer Reactions for How to Become a Millionaire Through Real Estate (Beginners!)

Tip on paying down the principal faster by splitting payments

Strategy of owning one rental property per year for 15 years to retire on a doctor's salary

Question about filtering Bigger Pockets by cash on cash return

Confusion over rent amount for a $300k house

Disappointment in the house drawing skills shown in the video

Inquiry about winding down a loan on a property without giving half back to taxes

Rental income amounts in different locations (Arizona, California)

Doubt about achieving similar results in California

Recommendation for a book called "The Hidden Money Gate" by Eric Danehart

Personal success story of acquiring multiple properties and potential early retirement

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.