Unlocking Real Estate Trends: Inventory Impact on Prices

- Authors

- Published on

- Published on

In this riveting episode of the BiggerPockets podcast, the dynamic duo of Dave Meyer and Lance Lambert dive headfirst into the tumultuous world of real estate trends. Lance, the co-founder of Resi Club, brings his expertise to the table, shedding light on the ever-changing landscape of the US housing market. They dissect the intricate web of inventory trends, a vital cog in the real estate machine, showcasing stark differences between regions like the vibrant Florida, bustling Texas, and the steadfast Midwest and Northeast.

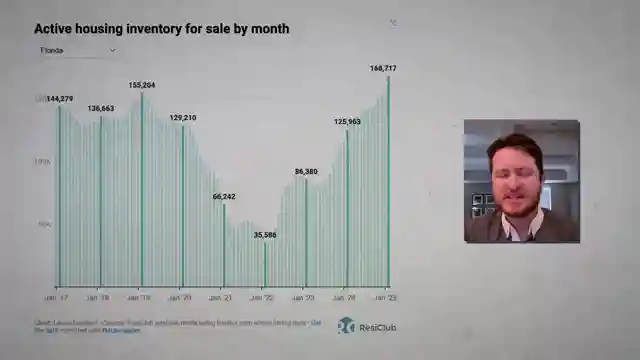

Lance's data-packed presentation unveils a tale of two markets, with some states like Texas and Colorado soaring above pre-pandemic inventory levels, while others such as Connecticut and New Jersey cling to tight supply conditions. The discussion delves deep into the repercussions of inventory levels mirroring or surpassing those of 2019, signaling a much-needed return to equilibrium after the chaotic housing demand surge during the pandemic. Lance paints a vivid picture of how surging active inventory can send shockwaves through pricing structures, as evidenced by the significant condo price drops in Florida.

The correlation between inventory fluctuations and price movements becomes glaringly apparent, with areas witnessing inventory spikes coinciding with price declines. Lance's insights underscore the significance of benchmarking current inventory against the stable 2019 levels, emphasizing the need for a nuanced understanding of market dynamics beyond mere year-on-year shifts. This episode serves as a beacon of knowledge for real estate enthusiasts, offering a glimpse into the intricate dance between supply, demand, and pricing in the ever-evolving realm of property investment.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch A Major Turn for the Housing Market (Buyers in CONTROL) | March 2025 Update on Youtube

Viewer Reactions for A Major Turn for the Housing Market (Buyers in CONTROL) | March 2025 Update

Florida condo market tanking due to insurance assessment after seaside condo collapse

Green and Brown indicators for buyers and sellers

Off market deals potentially skewing on market inventory metrics

Real estate market conditions since last summer

Affordability of houses

Excitement for the episode

Concerns about potential housing market crash worse than 2007-2009

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.