2025 Housing Market Analysis: Rising Prices, Shifting Metrics, and Stable Mortgage Rates

- Authors

- Published on

- Published on

On this episode of BiggerPockets, we delve into the tumultuous world of the 2025 housing market. Despite the odds stacked against it, the market continues to defy expectations with prices soaring amidst rising interest rates and inflation concerns. The real estate landscape is a battlefield where every move is crucial, and the stakes are higher than ever. As the dust settles, it becomes clear that the housing market is a beast of its own, unpredictable and unforgiving.

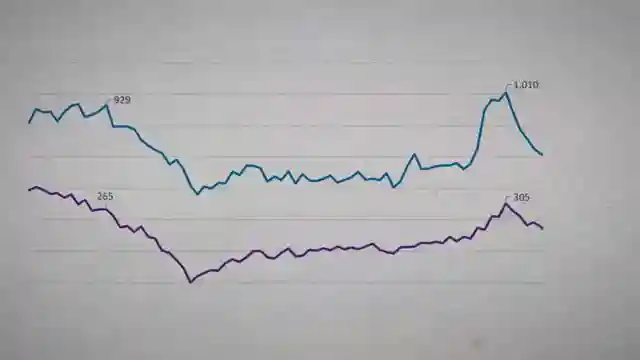

The team at BiggerPockets leaves no stone unturned as they dissect the shifting metrics that are reshaping the housing market. With prices up 4.8% year-over-year, surpassing long-term averages, the game is afoot. Real price changes, adjusted for inflation, reveal a more nuanced picture of the market's growth trajectory. The pulse of the housing market beats strong, with all 50 major US metro areas experiencing year-over-year price growth, a rare sight indeed.

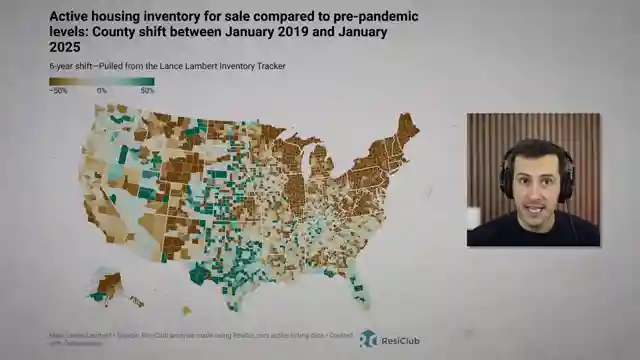

As the narrative unfolds, markets like Cleveland and Milwaukee emerge as unexpected frontrunners, boasting a staggering 15% year-over-year growth. The tides are turning, and investors must navigate the choppy waters with caution. Inventory levels are on the rise, hinting at a shift towards a more balanced market dynamic. Mortgage rates, a key player in this high-stakes game, have remained stable around 7%, influenced by looming inflation fears. The Fed's cautious approach to rate adjustments underscores the gravity of the situation, where every decision carries weight.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch A “Shift” Coming for the Housing Market? (Feb 2025 Update) on Youtube

Viewer Reactions for A “Shift” Coming for the Housing Market? (Feb 2025 Update)

Concerns about the real estate market being in a bubble and potentially crashing soon

Impact of inflation on housing prices

Speculation on a potential recession and shift to a buyers market

Effects of labor shortages on homebuilders due to deportations

Discrepancies in statistics and data manipulation

Views on the housing market being overpriced and potential for a crash

Impact of government policies and economic factors on the housing market

Observations on specific housing markets such as Milwaukee and Massachusetts

Criticisms of marketing and monetization strategies in content

Personal investment strategies and predictions for the market

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.