Mastering Real Estate: How David Achieved $200,000 Annual Cash Flow

- Authors

- Published on

- Published on

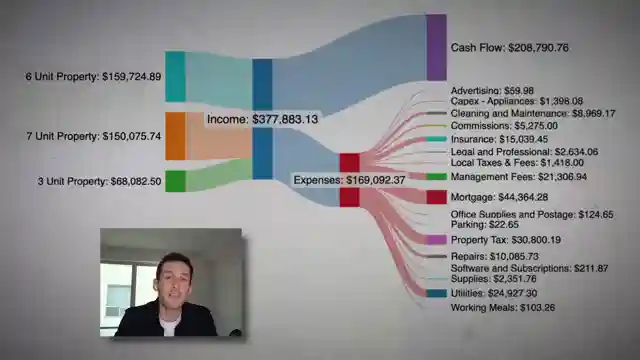

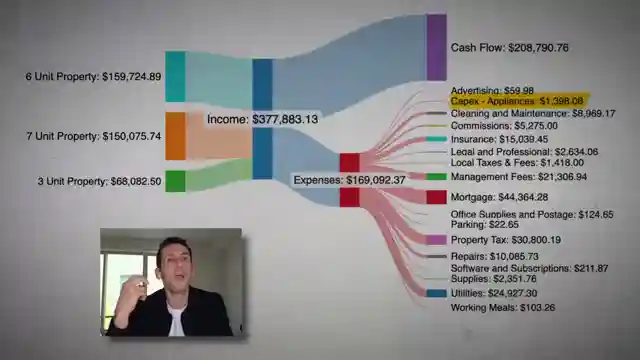

In this riveting episode of BiggerPockets, we delve into the thrilling world of real estate investing where one daring investor, David, has cracked the code to financial independence. With just 16 units and a bold $2 million investment over 13 years, he now rakes in a jaw-dropping $200,000 in annual cash flow. It's a tale of grit, strategy, and a relentless pursuit of success in the cutthroat realm of property management. David's secret? A laser focus on quality over quantity, ensuring his properties in solid neighborhoods remain in high demand, keeping those pesky vacancies at bay.

What sets David apart is his audacious approach to slashing mortgages, aggressively paying down debts to supercharge his cash flow. While some may raise an eyebrow at his seemingly modest repair expenses of $1,000 per unit per year, it's his bold $1,400 capex outlay that raises a few eyebrows. But hey, in the world of real estate, fortune favors the bold, and David is a prime example of this mantra. With a profit margin nearing a staggering 50%, he's not just playing in the big leagues; he's dominating them with finesse and flair.

For aspiring property moguls looking to replicate David's meteoric rise, the key lies in meticulous expense tracking, strategic reinvestment of profits, and a keen eye for long-term portfolio growth. It's not just about the numbers on paper; it's about the grit, determination, and unwavering focus on the end goal. So, buckle up, fellow investors, because the road to financial independence is paved with challenges, triumphs, and the occasional unexpected pit stop. And remember, in the thrilling world of real estate, fortune favors the bold, the diligent, and those who dare to dream big.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How to Make $200K/Year in Passive Income with Rental Properties on Youtube

Viewer Reactions for How to Make $200K/Year in Passive Income with Rental Properties

Discussion on the cash flow and expenses of owning multiple rental properties

Questions about the investor's down payments and purchase prices for the properties

Concerns about the low repair budget for the number of units owned

Speculation on the investor's mortgage payments and financial strategy

Comments on the amount spent annually and the sustainability of the investment

Questions about paying off mortgages versus keeping debt for tax purposes

Skepticism about the accuracy of the financial numbers provided

Mention of potential investment opportunities in XAI315K and Bitcoin

Comments on the current economic environment and the importance of a diversified portfolio

Advertisement for XAI315K presale and potential growth opportunities

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.