Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

- Authors

- Published on

- Published on

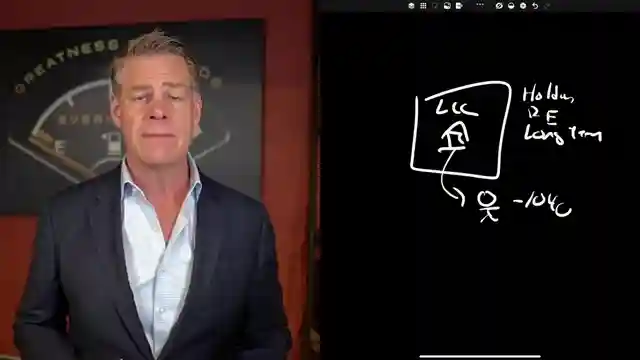

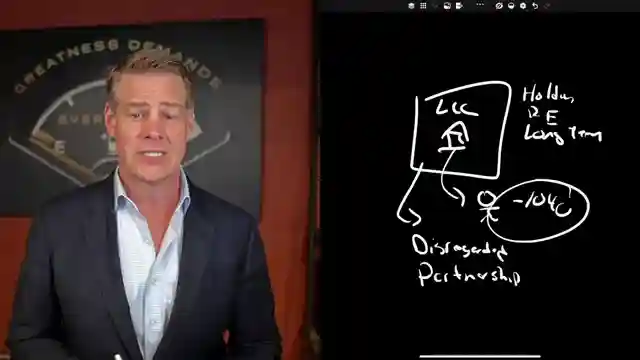

In this riveting video from Clint Coons Esq., the man himself delves into the tantalizing world of tax benefits for real estate investors through the strategic setup of limited liability companies (LLCs). For those passive investors basking in the glory of long-term real estate ownership, the key lies in preserving crucial tax benefits such as depreciation by ensuring the LLC mirrors personal ownership for tax purposes. It's a delicate dance between reaping the rewards of real estate investments and navigating the treacherous waters of tax liabilities.

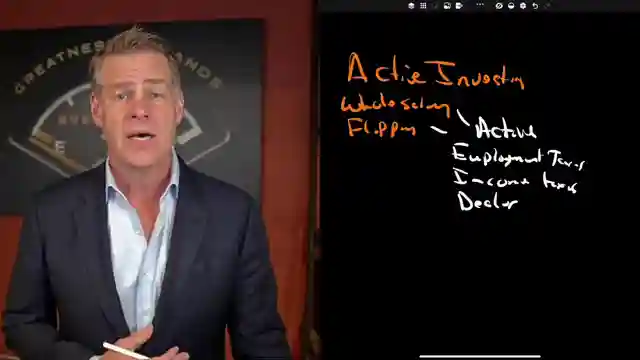

But wait, there's more! Enter the realm of active investors, where the plot thickens and the stakes are higher. Clint Coons reveals how LLCs can be wielded as powerful tools by active investors engaged in the adrenaline-fueled activities of property wholesaling or flipping. By strategically electing S or C corporation status for their LLCs, these investors can take control of how income flows down, minimizing the dreaded specter of employment and ordinary income taxes.

The drama unfolds as Anderson Advisors swoops in with a tantalizing offer of a free strategy session, promising to guide investors through the murky waters of business structure and tax elections. With the potential to unlock the secrets of out-of-state entities like Wyoming or Delaware, investors are urged to seize this golden opportunity to optimize their investment strategies. It's a high-octane journey through the twists and turns of real estate investing, where every decision could mean the difference between financial success and perilous tax pitfalls. So buckle up, smash that like button, and embark on this thrilling adventure with Clint Coons Esq. and the Anderson Advisors team.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch LLCs For Real Estate: When They Save You on Taxes (And When They Don’t!) on Youtube

Viewer Reactions for LLCs For Real Estate: When They Save You on Taxes (And When They Don’t!)

Some viewers found the video helpful in answering their questions

A user named ClintCoons is offering free consultations for setting up LLCs for real estate

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.