Navigating Real Estate Dilemmas: Buying vs. Investing in Pricey Markets

- Authors

- Published on

- Published on

In this riveting BiggerPockets episode, the team delves into the age-old conundrum of buying a house now or waiting for a better opportunity in pricey markets like Southern California. Melvin, a forum user, finds himself at a crossroads: should he stick to his $2,850 rent or take the plunge into homeownership with a hefty $5,600 mortgage? The analysis dissects the financial intricacies, from tax deductions to maintenance costs, revealing the long-term benefits of buying despite the initial strain.

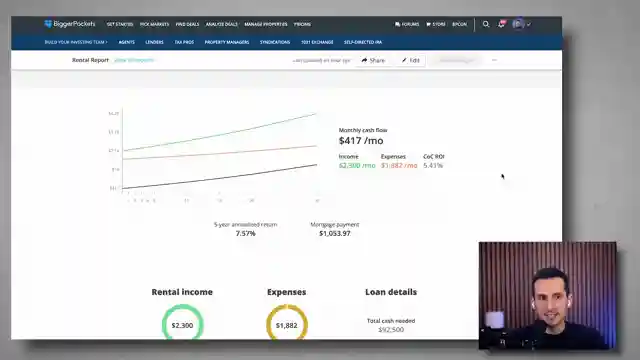

But wait, there's a twist! Melvin considers an alternative path: investing $100,000 in a rental property in the flourishing market of Indianapolis. This strategic move promises positive cash flow and potential appreciation, setting the stage for long-term financial growth. While house hacking is suggested as a viable option, Melvin's family hesitates due to personal comfort preferences, adding a layer of complexity to the decision-making process.

As the discussion unfolds, the team emphasizes the importance of aligning personal priorities with financial goals in navigating the unpredictable terrain of the real estate market. Whether opting for homeownership in the face of escalating prices or venturing into investment properties for diversification, the key lies in making a decision that resonates with individual aspirations. With California's housing market showing signs of resurgence, the stakes are high, urging Melvin and viewers alike to weigh their options carefully in pursuit of financial freedom and security.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Buying an Investment Property BEFORE First Home? Why It Makes Sense NOW on Youtube

Viewer Reactions for Buying an Investment Property BEFORE First Home? Why It Makes Sense NOW

Buying a rental property in a remote market with good cash flow helped one user eventually purchase a house in a sought-after school district and make a 7-figure profit.

Someone shared their success story of their investments growing from 34k to 220k.

There is a debate on whether it's better to invest in an apartment building for better cash flow compared to a single-family property.

Concerns about rent increases and property appreciation rates in different areas like Indianapolis and LA were discussed.

Suggestions were made about using a down payment to control an apartment rental property in a good appreciation market.

Comments on tax deductions for mortgage interest in California were made.

A user suggested being temporarily house poor in a nice area like Alhambra.

Limitations on mortgage interest deductions were mentioned.

There were some emojis and light-hearted comments about personal situations.

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.