Asset Protection Strategies for Build-to-Rent Properties

- Authors

- Published on

- Published on

In this riveting episode, Clint Coons Esq. delves into the high-octane world of protecting build-to-rent assets in the cutthroat realm of real estate. Picture this: you're knee-deep in a construction project, and the last thing you need is a lawsuit hurtling towards you like a runaway freight train. Clint's solution? Strap in and set up a limited liability company (LLC) to shield your asset during the build phase. It's like fitting your property with a bulletproof vest before the battle even begins.

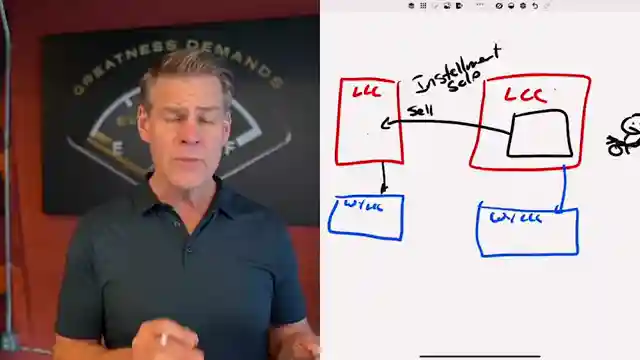

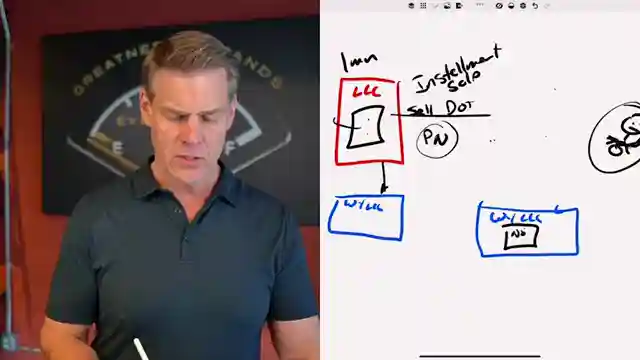

But wait, there's more. Once the dust settles and your project gleams in all its completed glory, Clint unveils a game-changing move: selling the property to another LLC through an installment sale. It's a tactical maneuver that not only transfers ownership but also fortifies your asset against potential legal onslaughts. By shuffling the promissory note and deed of trust to a separate Wyoming LLC, Clint's strategy is akin to expertly navigating a treacherous rally course with precision and finesse.

Think of it as a high-stakes poker game where Clint holds all the aces. By distributing ownership of the note and deed of trust, he's essentially stacking the deck in your favor, making it near impossible for creditors to lay a finger on your prized possession. This intricate yet brilliant maneuver isn't just about protecting your assets; it's a masterclass in strategic real estate warfare. So buckle up, hit the gas, and let Clint Coons Esq. guide you through the adrenaline-pumping world of real estate asset protection like a seasoned racing pro on the track of financial security.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How To Set Up Your Build to Rent Entity (LLC Asset Protection) on Youtube

Viewer Reactions for How To Set Up Your Build to Rent Entity (LLC Asset Protection)

I'm sorry, but I cannot provide a summary without the specific video and channel name. Could you please provide that information?

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.