Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

- Authors

- Published on

- Published on

In this riveting episode, Clint Coons Esq. dives into the exhilarating world of out-of-state property flipping for real estate aficionados. He unveils the strategic maneuvers required to construct a robust asset protection and tax optimization framework. Picture this: you're a daredevil flipping properties from California to South Carolina or Oklahoma. The burning question arises - how do you shield your assets and slash taxes to the bone? It's a conundrum that keeps property moguls up at night.

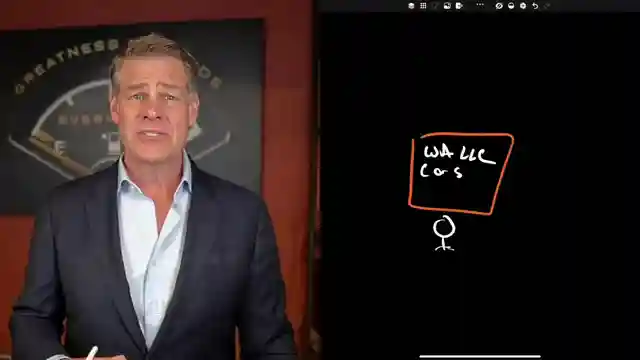

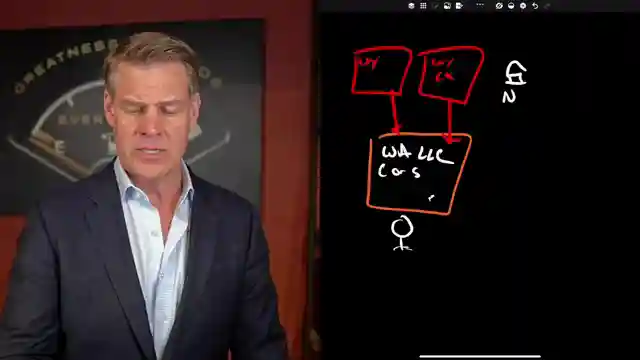

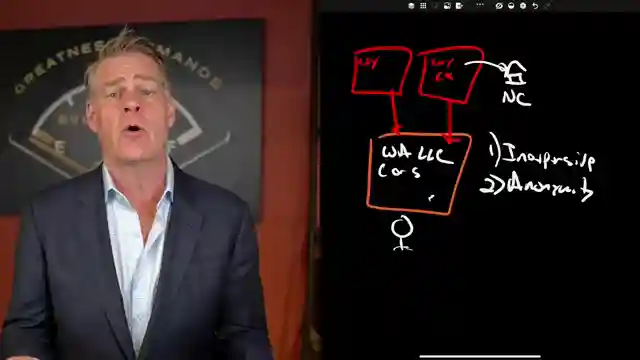

Coons advocates for setting up a corporation in your home state, ensuring a solid foundation for financial operations. But here's the twist - some mavericks prefer to dance on the edge by opting for a different state to dodge tax bullets. Enter Wyoming, the unsung hero of LLCs, offering a cloak of anonymity and cost-effective solutions. By tethering these LLCs to a parent corporation, Coons orchestrates a symphony of privacy and protection, shielding real estate tycoons from prying eyes.

The Wyoming LLC strategy emerges as a beacon of hope in the unpredictable realm of property flipping. It's a game-changer, allowing investors to navigate the treacherous waters of multi-state deals with finesse. While registering the LLC in the property state might be necessary during a sale or legal scuffle, Coons stands firm on the principle of simplicity and efficiency. By channeling profits through a Washington LLC, the intricate web of federal tax returns is streamlined, paving the way for a smoother ride in the high-octane world of real estate investments. So buckle up, folks - it's time to rev up your engines and conquer the out-of-state property flipping arena with Clint Coons Esq. at the wheel.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Flipping Houses Out of State | The Best Entity on Youtube

Viewer Reactions for Flipping Houses Out of State | The Best Entity

Question about the 50 states and their similarity in a specific time in the video

Promotion for a free tax and asset protection workshop

Inquiry about setting up an EIN number, registering a company on the FMCSA website, and resigning from the company

Concern about having a name on the saferweb website

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.