Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

- Authors

- Published on

- Published on

In this riveting episode by Clint Coons Esq., the burning question on every real estate investor's mind is tackled head-on: How do you extract money from your LLC without inviting the taxman to dinner? It's a conundrum as old as time itself, with Clint shedding light on the intricate dance between LLC structures and tax implications. From passive income streams like rental properties to the adrenaline-fueled world of flipping houses, each scenario demands a tailored approach to keep the tax wolves at bay.

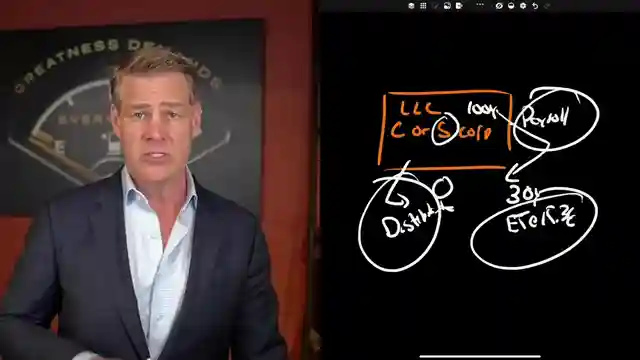

For the cool, calm waters of passive income, Clint advocates for the elegant simplicity of distributions. These nifty maneuvers allow you to siphon off profits from your LLC while keeping your tax liabilities in check. But beware the treacherous waters of loans - while they may seem like a lifeline, they can end up dragging you down into the murky depths of unnecessary taxation. So, when it's time to cash out, a well-timed distribution is your trusty lifeboat.

Now, if you find yourself in the fast-paced realm of active income, such as flipping properties, Clint unveils the power moves needed to navigate the tax minefield. With S Corporations, it's all about the delicate balance of payroll and distributions to optimize your tax strategy. Meanwhile, the enigmatic C Corporations throw a curveball with their double taxation antics, demanding a strategic approach to dividends and salaries. And let's not forget the cunning reimbursement strategy, a secret weapon for reclaiming expenses without ringing the tax alarm bells. So, whether you're a passive income guru or an active income adrenaline junkie, Clint Coons Esq. has the tax-saving tips to keep your LLC ship sailing smoothly in the choppy seas of real estate investing.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How to Pay Yourself From an LLC (Minimize Taxes!) on Youtube

Viewer Reactions for How to Pay Yourself From an LLC (Minimize Taxes!)

Tracking loans and interest rates for business

Website recommendations for managing multiple loans

Paying employees salaries to fund Roth IRA

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.