Mastering Land Trusts in Real Estate Investing

- Authors

- Published on

- Published on

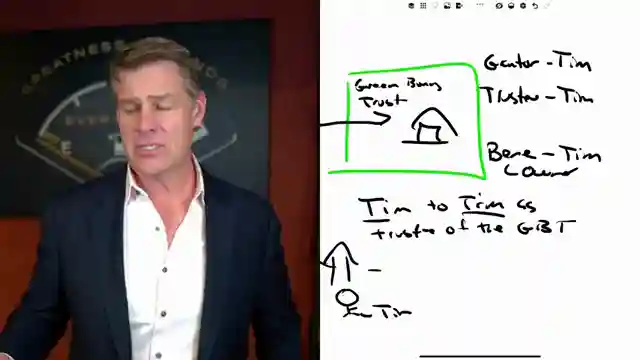

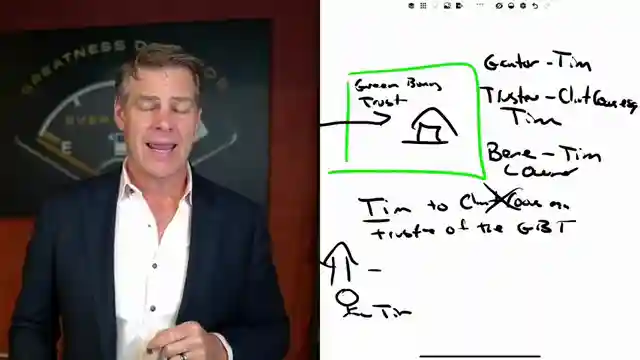

In this riveting episode, Clint Coons Esq. delves into the intriguing world of land trusts, a clever tool used by real estate investors to navigate the complexities of property ownership. These trusts, akin to living trusts, involve a grantor, trustee, and beneficiaries, offering a unique approach to asset management. Unlike living trusts, land trusts do not provide asset protection outside Florida, serving a specific purpose in minimizing transfer taxes and sidestepping do-on-sale clauses.

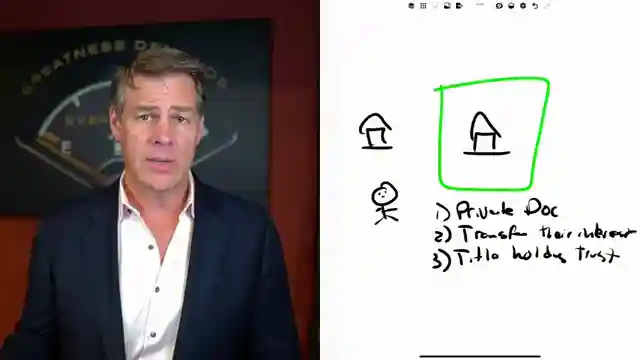

The beauty of a land trust lies in its ability to facilitate property transfers to LLCs without triggering unwanted consequences like acceleration clauses or transfer taxes. This maneuver allows investors to maintain control over their assets while reaping the benefits of limited liability protection. By enabling beneficiaries to transfer their interests, land trusts offer a flexible and efficient solution for real estate transactions.

One of the standout features of a land trust is its emphasis on privacy and anonymity, shielding property owners from potential harassment or prying creditors. Nominee trustees, often attorneys like Clint Coons Esquire, play a crucial role in managing land trusts while ensuring that beneficiaries retain control over their assets. By strategically utilizing land trusts, investors can navigate the intricate landscape of real estate ownership with finesse and discretion, safeguarding their interests and financial well-being.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch WATCH This Before Forming A Land Trust (Complete Breakdown) on Youtube

Viewer Reactions for WATCH This Before Forming A Land Trust (Complete Breakdown)

Using a trust to shield beneficiaries' identity when purchasing a property

Setting up a land trust and its benefits

Assigning interests to LLCs for property purchases

Trustee structure involving LLC and personal living trust

Specific question about assigning interests to an LLC serving as trustee

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.