Maximizing Real Estate Sweat Equity: Tax-Saving Strategies

- Authors

- Published on

- Published on

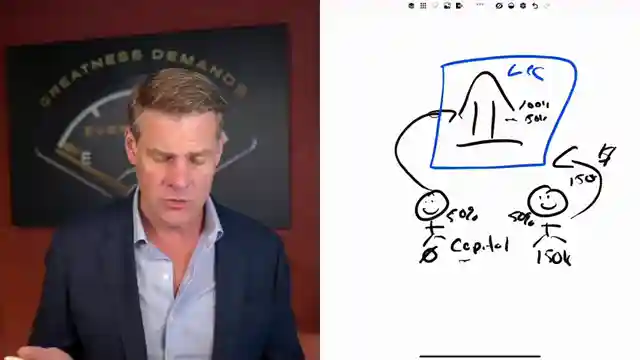

In this riveting episode by Clint Coons Esq., the man delves into the thrilling world of real estate sweat equity deals, where investors can avoid the taxman's grasp by cleverly structuring their partnerships. Picture this: one partner brings the cash or property, while the other sweats it out on the field, hammer in hand, paintbrush at the ready. The key here is to set up a limited liability company, a shield against tax troubles, and ensure fair profit splits through meticulous tracking of capital accounts. It's a high-stakes game, but with the right moves, you can outsmart the IRS and secure your earnings.

Now, imagine a scenario where a new player joins an existing deal as a sweat equity partner. Clint unveils a brilliant strategy: redraft the operating agreement to grant them a profits interest separate from the initial equity interest. This tactical maneuver not only shields them from immediate taxation but also paves the way for a smoother, more profitable partnership. By recalibrating the structure, the sweat equity partner can reap the rewards of their hard work without falling prey to premature tax burdens.

So, what's the bottom line? Clint Coons Esq. lays down the law: when venturing into sweat equity deals, precision is paramount. Whether you're starting from scratch or jumping into an ongoing project, the key lies in strategic structuring and foresight. By embracing the profits interest approach and recalibrating the partnership dynamics, investors can navigate the real estate landscape with finesse, safeguarding their assets and maximizing their returns. It's a game of wits, a dance with the taxman, but armed with Clint's expert advice, you can emerge victorious in the realm of real estate investments.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How Real Estate Investors Can Maximize Sweat Equity (Avoid Tax TRAPS) on Youtube

Viewer Reactions for How Real Estate Investors Can Maximize Sweat Equity (Avoid Tax TRAPS)

ClintCoons offers free consultations on the topic

lordsonic4567 is looking for a sweat equity partner

WealthTradie mentions a Home Equity Invoice Agreement for contractors and investors

iyona14granturismogt6gtspo7 questions the return on investment (ROI) aspect of the topic

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.