Ultimate Asset Protection Guide: Privacy Trusts and Wyoming LLCs

- Authors

- Published on

- Published on

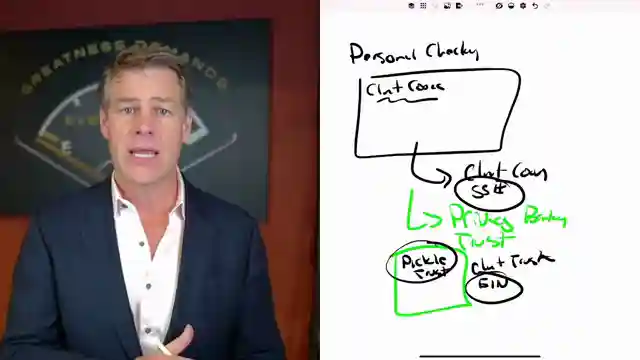

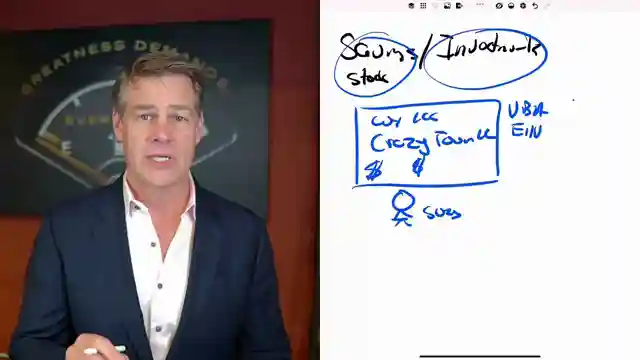

In this riveting video from Clint Coons, viewers are taken on a thrilling journey into the world of asset protection. Clint reveals the secrets to making your assets invisible to prying creditors and snoopers, ensuring your financial security. By utilizing various entities like privacy banking trusts for personal checking accounts and Wyoming LLCs such as Crazytown LLC for savings and investments, Clint demonstrates how to create a cloak of invisibility around your assets. These strategies not only shield your wealth from potential lawsuits but also prevent asset seizure in case of a default judgment.

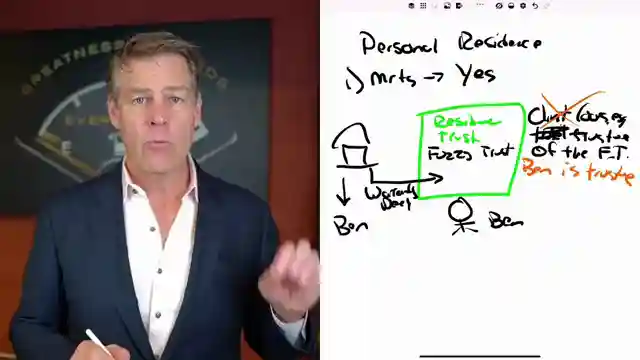

Clint's no-nonsense approach to asset protection is both enlightening and empowering. He emphasizes the importance of dissociating personal information from financial accounts to maintain privacy and security. By setting up entities like the Fuzzy Trust for personal residences, viewers learn how to safeguard their homes while preserving favorable tax benefits. Clint's expertise shines through as he navigates the complexities of asset protection with clarity and precision, offering practical solutions to ensure financial peace of mind.

Through Clint's guidance, viewers are equipped with the knowledge and tools needed to fortify their financial defenses. The Wyoming LLCs and residence trusts recommended by Clint serve as formidable barriers against potential threats, providing not only anonymity but also robust asset protection. With Clint's expert advice, viewers can take proactive steps to secure their wealth and shield themselves from the uncertainties of legal battles and asset seizures.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Here's How To Make Your Assets Invisible From Creditors on Youtube

Viewer Reactions for Here's How To Make Your Assets Invisible From Creditors

Trustee's creditors and liabilities at 14:57

Concern about disclosing assets in a lawsuit

Becoming a member by singing

Finding income through tax returns

Investing 385K in dividend stocks for 30% annual returns

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.